anti_fraud_practice

主要参考 Baesens, Höppner, and Verdonck (2018) 的讲解。

主要内容

- Periodic time features

- Network features

- the imbalance or skewness of the data and

- the various costs for different types of misclassification

- digit analysis

整理主要内容

## -- Attaching packages -------------------------------------------------------------------------------------------------------------- tidyverse 1.2.1 --

## √ ggplot2 3.1.0 √ purrr 0.2.5

## √ tibble 1.4.2 √ dplyr 0.7.8

## √ tidyr 0.8.2 √ stringr 1.3.1

## √ ggplot2 3.1.0 √ forcats 0.3.0

## -- Conflicts ----------------------------------------------------------------------------------------------------------------- tidyverse_conflicts() --

## x dplyr::filter() masks stats::filter()

## x dplyr::lag() masks stats::lag()

##

## Attaching package: 'data.table'

## The following objects are masked from 'package:dplyr':

##

## between, first, last

## The following object is masked from 'package:purrr':

##

## transpose

## here() starts at D:/weDo/anti_fraud_practice

##

## Attaching package: 'igraph'

## The following objects are masked from 'package:dplyr':

##

## as_data_frame, groups, union

## The following objects are masked from 'package:purrr':

##

## compose, simplify

## The following object is masked from 'package:tidyr':

##

## crossing

## The following object is masked from 'package:tibble':

##

## as_data_frame

## The following objects are masked from 'package:stats':

##

## decompose, spectrum

## The following object is masked from 'package:base':

##

## union

Imbalance phenomena

transfers <-

plyr::join_all(

list(

fread(here::here('data','transfer01.csv'))

,fread(here::here('data','transfer02.csv'))

,fread(here::here('data','transfer03.csv'))

)

,by ='id'

,type = 'left'

)

theme_nothing <-

function (base_size = 12, legend = FALSE)

{

if (legend) {

return(theme(axis.text = element_blank(), axis.title = element_blank(),

panel.background = element_blank(), panel.grid.major = element_blank(),

panel.grid.minor = element_blank(), axis.ticks.length = unit(0,

"cm"), panel.margin = unit(0, "lines"), plot.margin = unit(c(0,

0, 0, 0), "lines"), complete = TRUE))

}

else {

return(theme(line = element_blank(), rect = element_blank(),

text = element_blank(), axis.ticks.length = unit(0,

"cm"), legend.position = "none", panel.margin = unit(0,

"lines"), plot.margin = unit(c(0, 0, 0, 0), "lines"),

complete = TRUE))

}

}

# Print the first 6 rows of the dataset

head(transfers)

#> # A tibble: 6 x 13

#> id fraud_flag transfer_id timestamp orig_account_id benef_account_id

#> <int> <int> <chr> <int> <chr> <chr>

#> 1 226 0 xtr215694 21966103 X27769025 X86111129

#> 2 141 0 xtr671675 40885557 X15452684 X63932196

#> 3 493 0 xtr977348 19945191 X96278924 X56011266

#> 4 240 0 xtr655123 27404301 X27769025 X95653232

#> 5 445 0 xtr785302 6566236 X96278924 X85352318

#> 6 88 0 xtr187306 17576922 X15452684 X18544316

#> # ... with 7 more variables: benef_country <chr>, channel_cd <chr>,

#> # authentication_cd <chr>, communication_cd <chr>,

#> # empty_communication_flag <int>, orig_balance_before <int>,

#> # amount <int>

# Display the structure of the dataset

str(transfers)

#> Classes 'data.table' and 'data.frame': 628 obs. of 13 variables:

#> $ id : int 226 141 493 240 445 88 714 475 97 132 ...

#> $ fraud_flag : int 0 0 0 0 0 0 0 0 0 0 ...

#> $ transfer_id : chr "xtr215694" "xtr671675" "xtr977348" "xtr655123" ...

#> $ timestamp : int 21966103 40885557 19945191 27404301 6566236 17576922 29583007 14857126 22221450 38214048 ...

#> $ orig_account_id : chr "X27769025" "X15452684" "X96278924" "X27769025" ...

#> $ benef_account_id : chr "X86111129" "X63932196" "X56011266" "X95653232" ...

#> $ benef_country : chr "ISO03" "ISO03" "ISO03" "ISO03" ...

#> $ channel_cd : chr "CH01" "CH03" "CH04" "CH01" ...

#> $ authentication_cd : chr "AU02" "AU02" "AU05" "AU04" ...

#> $ communication_cd : chr "COM02" "COM02" "COM02" "COM02" ...

#> $ empty_communication_flag: int 0 0 0 0 0 0 0 0 0 0 ...

#> $ orig_balance_before : int 5412 7268 1971 10603 6228 4933 1779 1866 4582 6218 ...

#> $ amount : int 33 40 227 20 5176 54 71 27 28 59 ...

#> - attr(*, ".internal.selfref")=<externalptr>

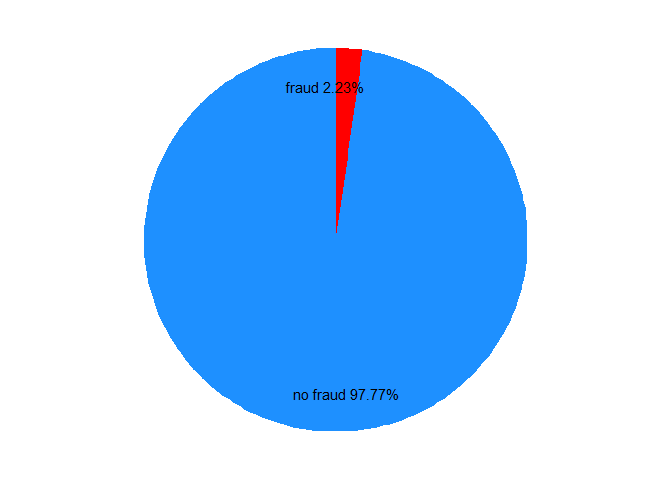

# Determine fraction of legitimate and fraudulent cases

class_distribution <- prop.table(table(transfers$fraud_flag))

print(class_distribution)

#>

#> 0 1

#> 0.97770701 0.02229299

# Make pie chart of column fraud_flag

df <- data.frame(class = c("no fraud", "fraud"),

pct = as.numeric(class_distribution)) %>%

mutate(class = factor(class, levels = c("no fraud", "fraud")),

cumulative = cumsum(pct), midpoint = cumulative - pct / 2,

label = paste0(class, " ", round(pct*100, 2), "%"))

# df

# with

# name pct cum_pct and label

ggplot(df, aes(x = 1, weight = pct, fill = class)) +

# for polar

scale_fill_manual(values = c("dodgerblue", "red")) +

# change default col

geom_bar(width = 1, position = "stack") +

coord_polar(theta = "y") +

geom_text(aes(x = 1.3, y = midpoint, label = label)) +

# the label pos is set by x.

theme_nothing()

Here is the imbalance of data.

Set confusion matrix with loss cost.

# Create vector predictions containing 0 for every transfer

predictions <- factor(rep.int(0, nrow(transfers)), levels = c(0, 1))

# Compute confusion matrix

library(caret)

levels(predictions)

#> [1] "0" "1"

levels(as.factor(transfers$fraud_flag))

#> [1] "0" "1"

# 错误: package e1071 is required

confusionMatrix(data = predictions, reference = as.factor(transfers$fraud_flag))

#> Confusion Matrix and Statistics

#>

#> Reference

#> Prediction 0 1

#> 0 614 14

#> 1 0 0

#>

#> Accuracy : 0.9777

#> 95% CI : (0.9629, 0.9878)

#> No Information Rate : 0.9777

#> P-Value [Acc > NIR] : 0.570441

#>

#> Kappa : 0

#> Mcnemar's Test P-Value : 0.000512

#>

#> Sensitivity : 1.0000

#> Specificity : 0.0000

#> Pos Pred Value : 0.9777

#> Neg Pred Value : NaN

#> Prevalence : 0.9777

#> Detection Rate : 0.9777

#> Detection Prevalence : 1.0000

#> Balanced Accuracy : 0.5000

#>

#> 'Positive' Class : 0

#>

# Compute cost of not detecting fraud

cost <- sum(transfers$amount[transfers$fraud_flag == 1])

print(cost)

#> [1] 64410

amount是借款本金,在不考虑逾期后回款的情况(这是欺诈用户的特征),那么都算损失。- 因此imbalance data 的主要问题不是准确率,而是降低损失。

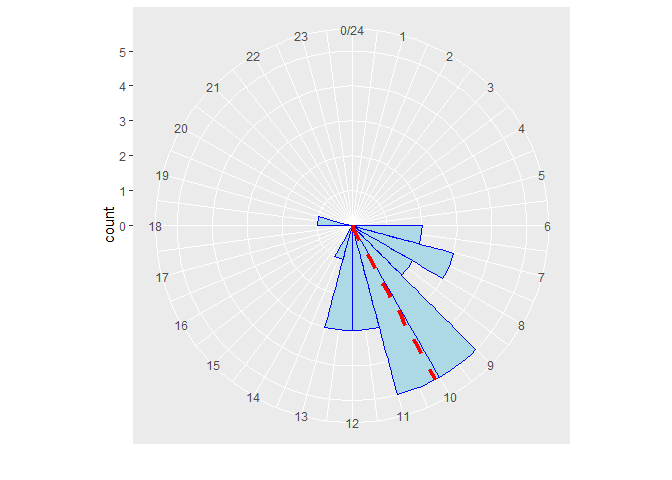

Time feature

Do not use arithmetic mean to compute an average timestamp!

Use periodic mean.

参考PPT 把特例举例出来。

因为24小时制,0点是跟11点和1点都非常近似。 以下展示图。 这个特征好。

The circular histogram is a visual representation of the timestamps of events.

解决方案是使用循环直方图。

timestamps <-

c(

"08:43:48","09:17:52","12:56:22","12:27:32","10:59:23","07:22:45"

,"11:13:59","10:13:26","10:07:01","06:09:56","12:43:17","07:07:35"

,"09:36:44","10:45:00","08:27:36","07:55:35","11:32:56","13:18:35"

,"11:09:51","09:46:33","06:59:12","10:19:36","09:39:47","09:39:46"

,"18:23:54"

)

也可以出考题。

Use Von Mises distribution.

# Convert the plain text to hours

library(lubridate)

ts <- as.numeric(hms(timestamps)) / 3600

# Convert the data to class circular

library(circular)

ts <- circular(ts, units = 'hours', template = "clock24")

# input is decimal timestamp

# Create the von Mises distribution estimates

estimates <- mle.vonmises(ts)

p_mean <- estimates$mu %% 24

p_mean

#> Circular Data:

#> Type = angles

#> Units = hours

#> Template = clock24

#> Modulo = asis

#> Zero = 1.570796

#> Rotation = clock

#> [1] 10.09938

# In the plot, 10 AM is the peroidic mean.

# Plot a circular histogram

clock <- ggplot(data.frame(ts), aes(x = ts)) +

geom_histogram(breaks = seq(0, 24), colour = "blue", fill = "lightblue") +

coord_polar() + scale_x_continuous("", limits = c(0, 24), breaks = seq(0, 24)) +

geom_vline(xintercept = as.numeric(p_mean), color = "red", linetype = 2, size = 1.5)

plot(clock)

因此发现有一个出现在晚上6点半左右,那么就算异常。

预测置信区间。

# Estimate the periodic mean and concentration on the first 24 timestamps

p_mean <- estimates$mu %% 24

concentration <- estimates$kappa

# Estimate densities of all 25 timestamps

densities <- dvonmises(ts, mu = p_mean, kappa = concentration)

# Check if the densities are larger than the cutoff of 95%-CI

cutoff <- dvonmises(qvonmises((1 - .95)/2, mu = p_mean, kappa = concentration), mu = p_mean, kappa = concentration)

# Define the variable time_feature

time_feature <- densities >= cutoff

print(cbind.data.frame(ts, time_feature))

#> ts time_feature

#> 1 8.730000 TRUE

#> 2 9.297778 TRUE

#> 3 12.939444 TRUE

#> 4 12.458889 TRUE

#> 5 10.989722 TRUE

#> 6 7.379167 TRUE

#> 7 11.233056 TRUE

#> 8 10.223889 TRUE

#> 9 10.116944 TRUE

#> 10 6.165556 TRUE

#> 11 12.721389 TRUE

#> 12 7.126389 TRUE

#> 13 9.612222 TRUE

#> 14 10.750000 TRUE

#> 15 8.460000 TRUE

#> 16 7.926389 TRUE

#> 17 11.548889 TRUE

#> 18 13.309722 TRUE

#> 19 11.164167 TRUE

#> 20 9.775833 TRUE

#> 21 6.986667 TRUE

#> 22 10.326667 TRUE

#> 23 9.663056 TRUE

#> 24 9.662778 TRUE

#> 25 18.398333 FALSE

# time_feature == FALSE => outlier.

这个人可以follow

segment的代码增加

von Mises probability distribution

Frequency feature

查询一个用户不同渠道重复的频率。

trans_Bob <-

plyr::join_all(

list(

fread(here::here('data','trans_Bob01.csv'))

,fread(here::here('data','trans_Bob02.csv'))

,fread(here::here('data','trans_Bob03.csv'))

)

,by ='id'

,type = 'left'

)

# Frequency feature based on channel_cd

frequency_fun <- function(steps, channel) {

n <- length(steps)

frequency <- sum(channel[1:n] == channel[n + 1])

# The value of the current rows is equal to the previous rows.

# Count 1.

return(frequency)

}

# Create freq_channel feature

freq_channel <-

zoo::rollapply(

trans_Bob$transfer_id

,width = list(-1:-length(trans_Bob$transfer_id))

,partial = TRUE

,FUN = frequency_fun

,trans_Bob$channel_cd

)

length(freq_channel)

#> [1] 16

# Print the features channel_cd, freq_channel and fraud_flag next to each other

freq_channel <- c(0, freq_channel)

freq_channel_tbl01 <-

cbind.data.frame(trans_Bob$channel_cd, freq_channel, trans_Bob$fraud_flag) %>%

set_names('channel_cd','freq_channel','fraud_flag')

Another way.

freq_channel_tbl02 <-

trans_Bob %>%

mutate(channel_cd = factor(channel_cd)) %>%

group_by(account_name,channel_cd) %>%

arrange(timestamp) %>%

mutate(freq_channel = row_number()-1) %>%

ungroup() %>%

select(-account_name) %>%

select('channel_cd','freq_channel','fraud_flag')

setequal(freq_channel_tbl01,freq_channel_tbl02)

#> [1] TRUE

freq_channel_tbl02 %>%

tail

#> # A tibble: 6 x 3

#> channel_cd freq_channel fraud_flag

#> <fct> <dbl> <int>

#> 1 CH07 6 0

#> 2 CH06 3 0

#> 3 CH02 2 0

#> 4 CH07 7 0

#> 5 CH06 4 0

#> 6 CH05 0 1

注意欺诈发生于freq_channel=0的时候,这是freq feature的作用。

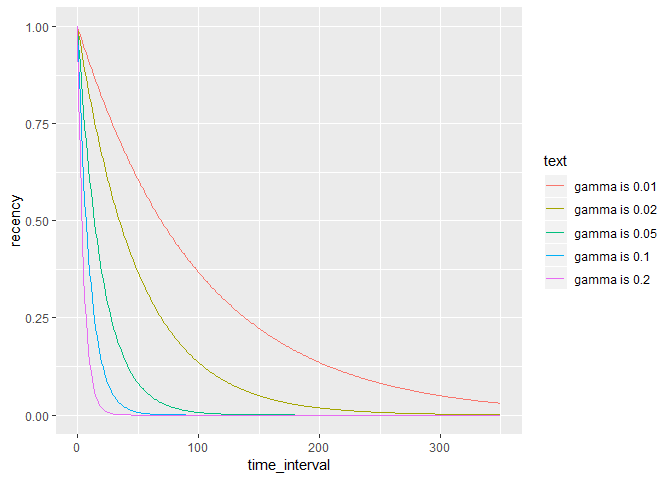

Recency features

how to add bracket in ggplot

knitr::include_graphics(here::here('pic','recencyfeature.png'))

[\text{recency} = e^{-\gamma t}]

-

(e^n n<0 \in (0,1)) - (t) is time interval between two consecutive events of the same type

- (\gamma) close to 0 (e.g. 0.01, 0.02, 0.05), control (t) effect

expand.grid(

time_interval = 0:350

,gamma = c(0.01,0.02,0.05,0.10,0.20)

) %>%

mutate(recency = exp(-time_interval*gamma)

,text = glue::glue('gamma is {gamma}')

) %>%

ggplot(aes(x = time_interval,y = recency, col = text)) +

geom_line()

- recency descreases by time interval.

- recency desceases more by gamma increasing.

recency_fun <- function(t, gamma, auth_cd, freq_auth) {

n_t <- length(t)

if (freq_auth[n_t] == 0) {

recency <- 0 # recency = 0 when frequency = 0

} else {

time_diff <- t[1] - max(t[2:n_t][auth_cd[(n_t-1):1] == auth_cd[n_t]]) # time-interval = current timestamp

# - timestamp of previous transfer with same auth_cd

recency <- exp(-gamma * time_diff)

}

return(recency)

}

trans <-

plyr::join_all(

list(

fread(here::here('data','trans01.csv'))

,fread(here::here('data','trans02.csv'))

,fread(here::here('data','trans03.csv'))

)

,by ='id'

,type = 'left'

)

freq_channel_data <-

trans %>%

arrange(timestamp) %>%

group_by(account_name,channel_cd) %>%

mutate(

time_diff = timestamp-lag(timestamp)

,gamma = 0.05116856

,rec_channel =

ifelse(freq_channel == 0,0,exp(-time_diff*gamma))

# if (freq_channel == 0) {

# print(0)

# } else {

# print(exp(-time_diff*gamma))

# }

) %>%

select(account_name, channel_cd, timestamp,freq_channel, rec_channel, fraud_flag)

注意rec_channel=0产生了欺诈行为。

transfers %>%

mutate(channel_cd = factor(channel_cd)) %>%

# Freq feature

group_by(orig_account_id,channel_cd) %>%

arrange(timestamp) %>%

mutate(freq_channel = row_number()-1) %>%

ungroup() %>%

# Rec feature

group_by(orig_account_id,channel_cd) %>%

mutate(

time_diff = timestamp-lag(timestamp)

,gamma = 0.05116856

,rec_channel =

ifelse(freq_channel == 0,0,exp(-time_diff*gamma))

) %>%

ungroup() %>%

# summary

group_by(fraud_flag) %>%

select(freq_channel, rec_channel) %>%

nest() %>%

transmute(desc = map(data,psych::describe)) %>%

unnest()

#> # A tibble: 4 x 13

#> vars n mean sd median trimmed mad min max range

#> <int> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

#> 1 1 614 3.50e+1 3.30e+1 25 3.02e+1 29.7 0 1.37e+2 1.37e+2

#> 2 2 614 6.07e-2 2.28e-1 0 1.45e-3 0 0 1.00e+0 1.00e+0

#> 3 1 14 3.09e+1 3.49e+1 12.5 2.94e+1 18.5 0 8.00e+1 8.00e+1

#> 4 2 14 1.39e-4 5.20e-4 0 5.22e-7 0 0 1.94e-3 1.94e-3

#> # ... with 3 more variables: skew <dbl>, kurtosis <dbl>, se <dbl>

目前欺诈用户的统计指标在这两种变量中差异很大。

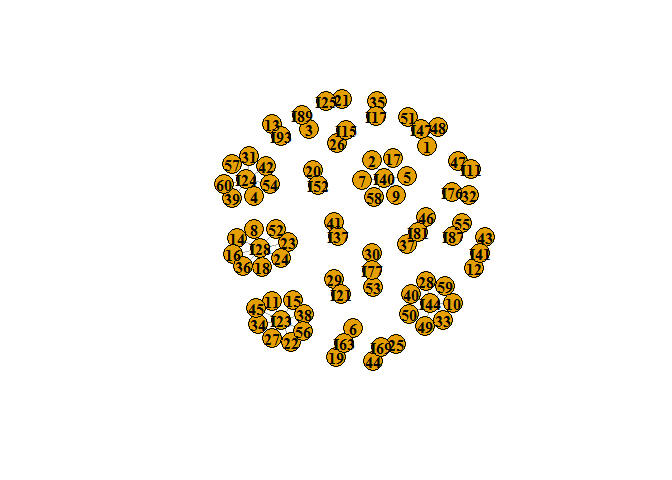

Network features

chai: 小样本进行分析

Intro

# Load the igraph library

library(igraph)

transfers <- fread(here::here('data','transfer_chp2.csv'))

# Have a look at the data

head(transfers)

#> # A tibble: 6 x 7

#> V1 originator beneficiary amount time benef_country payment_channel

#> <int> <chr> <chr> <dbl> <chr> <chr> <chr>

#> 1 1 I47 I87 1464. 15:12 CAN CHAN_01

#> 2 2 I40 I61 143. 15:40 GBR CHAN_01

#> 3 3 I89 I61 53.3 11:44 GBR CHAN_05

#> 4 4 I24 I52 226. 14:55 GBR CHAN_03

#> 5 5 I40 I87 1151. 21:20 CAN CHAN_03

#> 6 6 I63 I54 110. 20:21 GBR CHAN_03

nrow(transfers)

#> [1] 60

# Create an undirected network from the dataset

net <- graph_from_data_frame(transfers, directed = F)

net

#> IGRAPH 85d2749 UN-- 82 60 --

#> + attr: name (v/c), beneficiary (e/c), amount (e/n), time (e/c),

#> | benef_country (e/c), payment_channel (e/c)

#> + edges from 85d2749 (vertex names):

#> [1] 1 --I47 2 --I40 3 --I89 4 --I24 5 --I40 6 --I63 7 --I40 8 --I28

#> [9] 9 --I40 10--I44 11--I23 12--I41 13--I93 14--I28 15--I23 16--I28

#> [17] 17--I40 18--I28 19--I63 20--I52 21--I25 22--I23 23--I28 24--I28

#> [25] 25--I69 26--I15 27--I23 28--I44 29--I21 30--I77 31--I24 32--I76

#> [33] 33--I44 34--I23 35--I17 36--I28 37--I81 38--I23 39--I24 40--I44

#> [41] 41--I37 42--I24 43--I41 44--I69 45--I23 46--I81 47--I11 48--I47

#> [49] 49--I44 50--I44 51--I47 52--I28 53--I77 54--I24 55--I87 56--I23

#> + ... omitted several edges

# Plot the network with the vertex labels in bold and black

plot(net,

vertex.label.color = 'black',

vertex.label.font = 2)

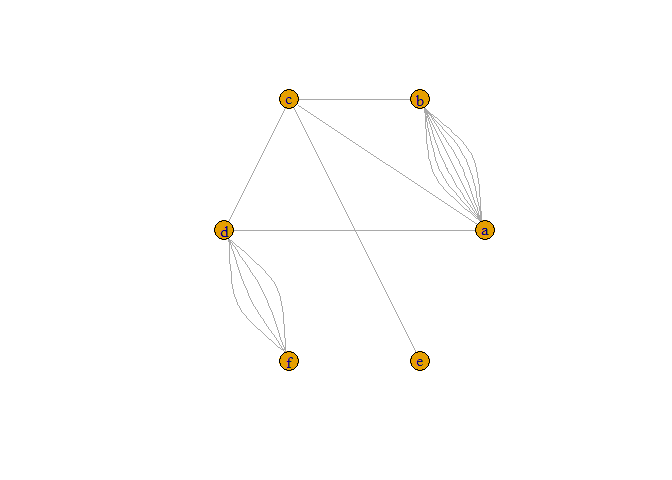

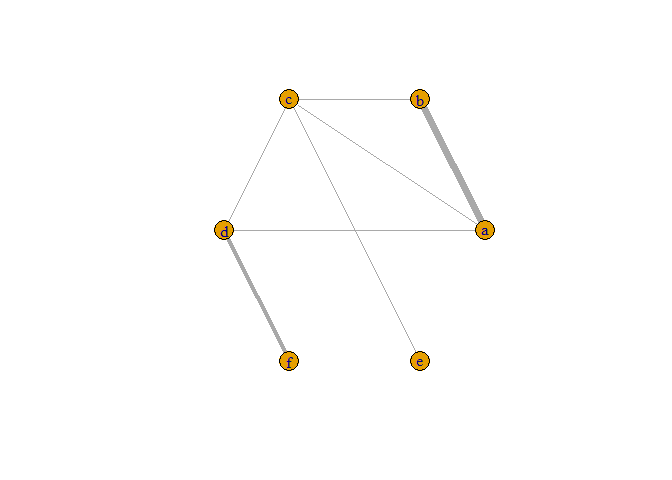

edges <- fread(here::here('data','edges.csv')) %>%

select(-id)

# Load igraph and create a network from the data frame

net <- graph_from_data_frame(edges, directed = FALSE)

# Plot the network with the multiple edges

plot(net, layout = layout.circle)

# Specify new edge attributes width and curved

E(net)$width <- count.multiple(net)

E(net)$curved <- FALSE

# Check the new edge attributes and plot the network with overlapping edges

edge_attr(net)

#> $width

#> [1] 7 7 7 7 7 7 7 1 1 1 4 4 4 4 1 1

#>

#> $curved

#> [1] FALSE FALSE FALSE FALSE FALSE FALSE FALSE FALSE FALSE FALSE FALSE

#> [12] FALSE FALSE FALSE FALSE FALSE

plot(net, layout = layout.circle)

Fraudsters tend to cluster together:

- are attending the same events/activities

- are involved in the same crimes

- use the same resources

- are sometimes one and the same person (identity theft)

- Homophily in social networks (from sociology)

People have a strong tendency to associate with other whom they perceive as being similar to themselves in some way. - Homophily in fraud networks

Fraudsters are more likely to be connected to other fraudsters, and legitimate people are more likely to be connected to other legitimate people.

因此对于VIP识别的数据,VIP用户也存在 Homophily。

- Non-relational model

sample independent Behavior of one node might influence behavior of other nodes Correlated behavior between nodes - Relational model

Relational neighbor classifier The relational neighbor classifier, in particular, predicts a node’s class based on its neighboring nodes and adjacent edges. (这是算法逻辑)

因此传统的非关系模型可能不work,也是有原因的。

account_typeis a nominal variable -> useassortativity_nominal.

# Add account_type as an attribute to the nodes of the network

V(net)$account_type <- account_info$type

# Have a look at the vertex attributes

print(vertex_attr(net))

# Check for homophily based on account_type

assortativity_nominal(net, types = V(net)$account_type, directed = FALSE)

# 0.1810621

The assortativity coefficient is positive which means that accounts of the same type tend to connect to each other.

这个地方的例子没理解。

# Each account type is assigned a color

vertex_colors <- c("grey", "lightblue", "darkorange")

# Add attribute color to V(net) which holds the color of each node depending on its account_type

V(net)$color <- vertex_colors[V(net)$account_type]

# Plot the network

plot(net)

同类型的用户聚集。

- money mule

A money mule or sometimes referred to as a “smurfer” is a person who transfers money acquired illegally.

transfers <- fread(here::here('data','transfers_chp2_02.csv'))

account_info <- fread(here::here('data','account_info.csv'))

# From data frame to graph

net <- graph_from_data_frame(transfers, directed = FALSE)

# Plot the network; color nodes according to isMoneyMule-variable

V(net)$color <- ifelse(account_info$isMoneyMule, "darkorange", "slateblue1")

plot(net, vertex.label.color = "black", vertex.label.font = 2, vertex.size = 18)

# Find the id of the money mule accounts

print(account_info$id[account_info$isMoneyMule == TRUE])

# Create subgraph containing node "I41" and all money mules nodes

subnet <- subgraph(net, v = c("I41", "I47", "I87", "I20"))

# Error in as.igraph.vs(graph, v) : Invalid vertex names

# Compute the money mule probability of node "I41" based on the neighbors

strength(subnet, v = "I41") / strength(net, v = "I41")

# Error in "igraph" %in% class(graph) : 找不到对象'subnet'

为什么箭头没有显示出来。

as_data_frame(x, what = c("edges", "vertices", "both"))可以将igraph的对象变成data.frame。vertex_*n. 顶点;头顶;天顶,也就是Nodes的意思。

Feature Engineering

There are three kinds of variable we can build.

-

- Degree

Number of edges. If Network has N nodes, then normalizing means dividing by N − 1 体现连接个数

- Degree

-

- Closeness

Inverse distance of a node to all other nodes in the network ((1+1+2)^{-1}) normalized - ((\frac{(1+1+2)}{3})^{-1}) 因此离各点越近,Closeness越高

- Closeness

-

- Betweenness

Number of times that a node or edge occurs in the geodesics of the network normalized - (\frac{…}{N}) 体现中间人的重要性

- Betweenness

寻找这本文献 Analysis D D and Raya V 2013 Social Network Analysis, Methods and Measurements Calculations pp 2–5

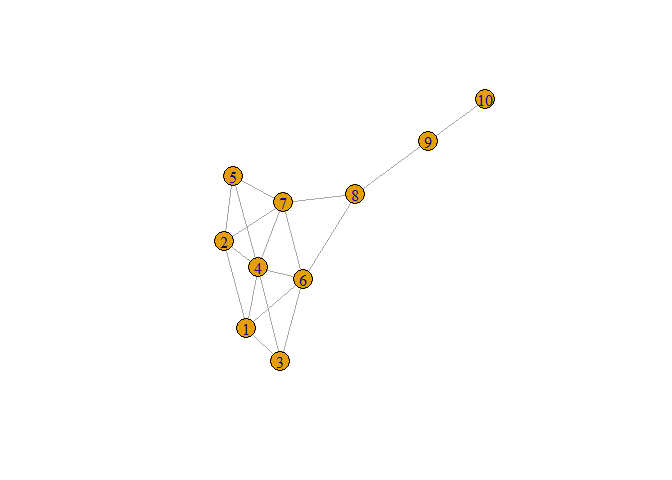

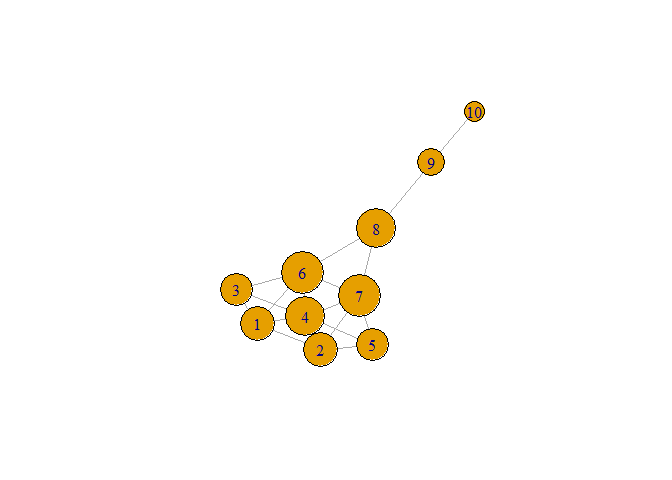

kite <- fread(here::here('data','kite.csv')) %>%

select(-id)

kite <- graph_from_data_frame(kite,directed = F)

plot(kite)

degree

# Find the degree of each node

degree(kite)

#> 1 2 3 4 5 6 7 8 9 10

#> 4 4 3 6 3 5 5 3 2 1

# Which node has the largest degree?

which.max(degree(kite))

#> 4

#> 4

# Plot kite with vertex.size proportional to the degree of each node

plot(kite, vertex.size = 6 * degree(kite))

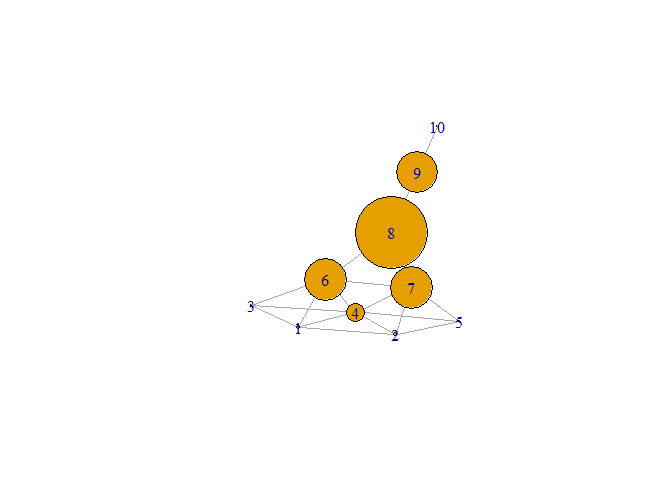

Closeness

# Find the closeness of each node

closeness(kite)

#> 1 2 3 4 5 6

#> 0.05882353 0.05882353 0.05555556 0.06666667 0.05555556 0.07142857

#> 7 8 9 10

#> 0.07142857 0.06666667 0.04761905 0.03448276

# Which node has the largest closeness?

which.max(closeness(kite))

#> 6

#> 6

# Plot kite with vertex.size proportional to the closeness of each node

plot(kite, vertex.size = 500 * closeness(kite))

betweenness

# Find the betweenness of each node

betweenness(kite)

#> 1 2 3 4 5 6

#> 0.8333333 0.8333333 0.0000000 3.6666667 0.0000000 8.3333333

#> 7 8 9 10

#> 8.3333333 14.0000000 8.0000000 0.0000000

# Which node has the largest betweenness?

which.max(betweenness(kite))

#> 8

#> 8

# Plot kite with vertex.size proportional to the betweenness of each node

plot(kite, vertex.size = 5 * betweenness(kite))

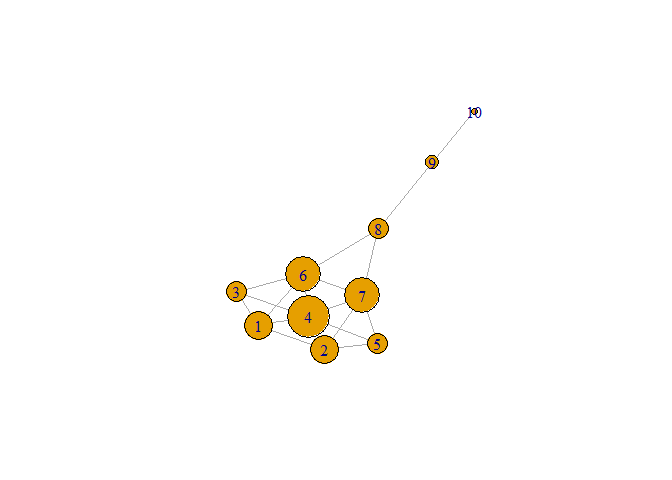

net <- fread(here::here('data','net.csv')) %>%

select(-id)

net <- graph_from_data_frame(net,directed = F)

account_info <- fread(here::here('data','account_info_chp2.csv')) %>%

select(-index)

Combination of the new features

# Plot network and print account info

plot(net)

legend("bottomleft", legend = c("known money mule", "legit account"), fill = c("darkorange", "lightblue"), bty = "n")

print(account_info)

#> id isMoneyMule type

#> 1: I47 TRUE 3

#> 2: I40 FALSE 3

#> 3: I89 FALSE 1

#> 4: I24 FALSE 2

#> 5: I63 FALSE 2

#> 6: I28 FALSE 1

#> 7: I44 FALSE 1

#> 8: I23 FALSE 1

#> 9: I41 TRUE 3

#> 10: I93 FALSE 2

#> 11: I52 FALSE 2

#> 12: I25 FALSE 1

#> 13: I69 FALSE 2

#> 14: I15 FALSE 1

#> 15: I21 FALSE 2

#> 16: I77 FALSE 1

#> 17: I76 FALSE 2

#> 18: I17 FALSE 1

#> 19: I81 FALSE 1

#> 20: I37 FALSE 3

#> 21: I11 FALSE 3

#> 22: I87 TRUE 3

#> 23: I61 FALSE 1

#> 24: I54 FALSE 1

#> 25: I80 FALSE 1

#> 26: I20 TRUE 3

#> 27: I64 FALSE 2

#> 28: I46 FALSE 2

#> 29: I19 FALSE 2

#> 30: I55 FALSE 1

#> 31: I14 FALSE 1

#> 32: I30 FALSE 2

#> 33: I29 FALSE 2

#> 34: I35 FALSE 2

#> 35: I27 FALSE 2

#> 36: I60 FALSE 1

#> 37: I22 FALSE 1

#> 38: I66 FALSE 2

#> id isMoneyMule type

# Degree

account_info$degree <- degree(net, normalized = T)

# degree colname is I47 or something.

# Closeness

account_info$closeness <- closeness(net, normalized = T)

# Betweenness

account_info$betweenness <- betweenness(net, normalized = T)

print(account_info)

#> id isMoneyMule type degree closeness betweenness

#> 1: I47 TRUE 3 0.08108108 0.3775510 0.0000000000

#> 2: I40 FALSE 3 0.16216216 0.3425926 0.1979479479

#> 3: I89 FALSE 1 0.05405405 0.2587413 0.0000000000

#> 4: I24 FALSE 2 0.18918919 0.3737374 0.2600100100

#> 5: I63 FALSE 2 0.13513514 0.2983871 0.0350350350

#> 6: I28 FALSE 1 0.21621622 0.3627451 0.2942942943

#> 7: I44 FALSE 1 0.18918919 0.3663366 0.2209709710

#> 8: I23 FALSE 1 0.21621622 0.3592233 0.2757757758

#> 9: I41 TRUE 3 0.13513514 0.4352941 0.2817817818

#> 10: I93 FALSE 2 0.08108108 0.3274336 0.0838338338

#> 11: I52 FALSE 2 0.05405405 0.2846154 0.0000000000

#> 12: I25 FALSE 1 0.08108108 0.2781955 0.0000000000

#> 13: I69 FALSE 2 0.08108108 0.2720588 0.0007507508

#> 14: I15 FALSE 1 0.05405405 0.2700730 0.0000000000

#> 15: I21 FALSE 2 0.08108108 0.2700730 0.0000000000

#> 16: I77 FALSE 1 0.08108108 0.2700730 0.0000000000

#> 17: I76 FALSE 2 0.05405405 0.3032787 0.0315315315

#> 18: I17 FALSE 1 0.05405405 0.3217391 0.0155155155

#> 19: I81 FALSE 1 0.08108108 0.2720588 0.0007507508

#> 20: I37 FALSE 3 0.08108108 0.3663366 0.0950950951

#> 21: I11 FALSE 3 0.16216216 0.4352941 0.3753753754

#> 22: I87 TRUE 3 0.05405405 0.2587413 0.0000000000

#> 23: I61 FALSE 1 0.05405405 0.2761194 0.0000000000

#> 24: I54 FALSE 1 0.02702703 0.2569444 0.0000000000

#> 25: I80 FALSE 1 0.13513514 0.4157303 0.2309809810

#> 26: I20 TRUE 3 0.08108108 0.3057851 0.0385385385

#> 27: I64 FALSE 2 0.05405405 0.2700730 0.0000000000

#> 28: I46 FALSE 2 0.02702703 0.2661871 0.0000000000

#> 29: I19 FALSE 2 0.05405405 0.2700730 0.0000000000

#> 30: I55 FALSE 1 0.08108108 0.2781955 0.0000000000

#> 31: I14 FALSE 1 0.08108108 0.3008130 0.0347847848

#> 32: I30 FALSE 2 0.05405405 0.2700730 0.0000000000

#> 33: I29 FALSE 2 0.08108108 0.2700730 0.0000000000

#> 34: I35 FALSE 2 0.02702703 0.2700730 0.0000000000

#> 35: I27 FALSE 2 0.02702703 0.2740741 0.0000000000

#> 36: I60 FALSE 1 0.02702703 0.2661871 0.0000000000

#> 37: I22 FALSE 1 0.02702703 0.2740741 0.0000000000

#> 38: I66 FALSE 2 0.02702703 0.2740741 0.0000000000

#> id isMoneyMule type degree closeness betweenness

account_info %>% distinct(type)

#> # A tibble: 3 x 1

#> type

#> <int>

#> 1 3

#> 2 1

#> 3 2

- 接下来可以使用 non relational model 进行分析了,例如决策树。

- 但是数据还是存在imbalance的问题,因此需要处理。

如何用SQL 翻译? 先整理 PPT

Imbalanced class distributions

xs 的数据也存在不平衡的问题,因此变量需要进行以上特征工程。

- 准备每个x的inserttime

sampling 只对 train 进行而不对 test 进行

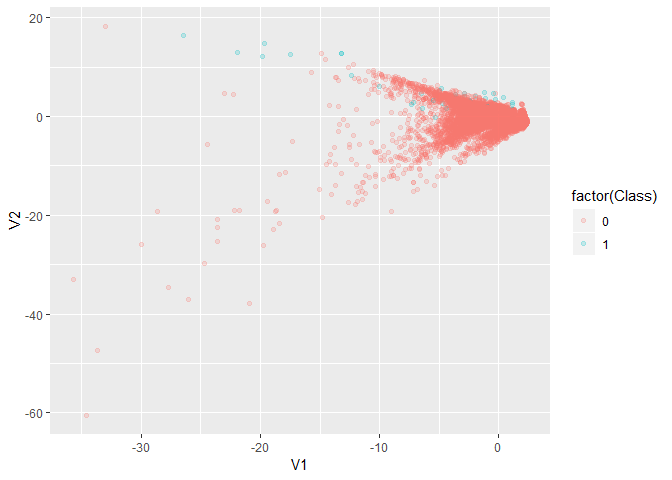

Kaggle的反欺诈数据。

library(data.table)

creditcard <- fread(here::here('data','creditcard.csv'))

creditcard %>%

mutate(index = rep_len(1:4,nrow(.))) %>%

group_by(index) %>%

nest() %>%

mutate(data1 = map2(data,index,~write_excel_csv(.x,here::here('data',paste0('creditcard_',.y,'.csv')))))

library(data.table)

library(tidyverse)

creditcard <-

bind_rows(

map(1:4

,~ paste0('creditcard_',.,'.csv') %>%

here::here('data',.) %>%

fread()

)

) %>%

dplyr::sample_frac(0.1)

creditcard %>%

# nrow

pryr::object_size()

#> 7.07 MB

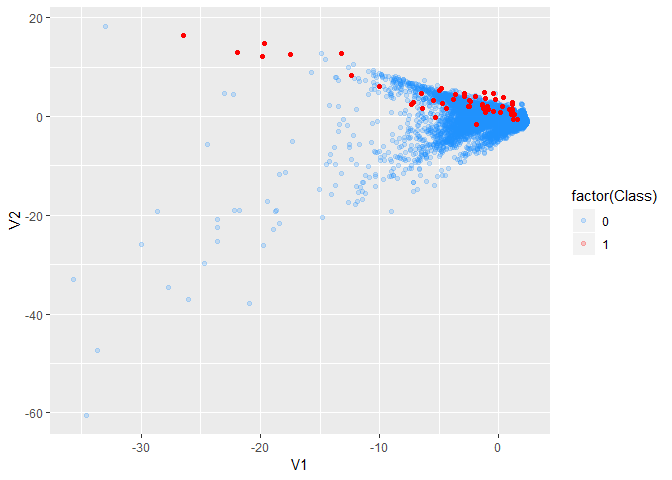

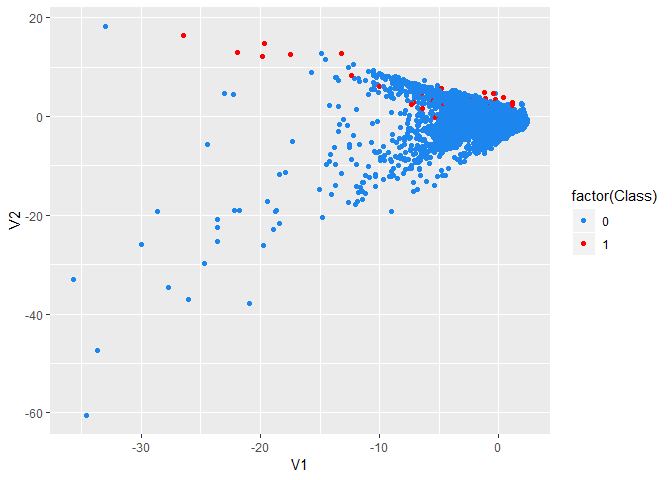

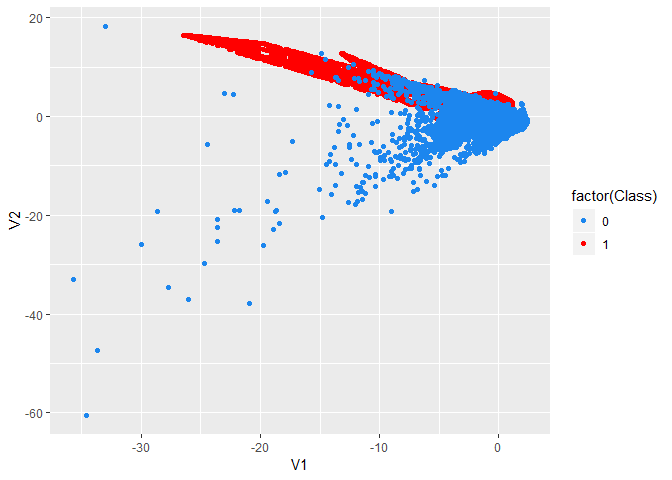

creditcard %>%

ggplot(aes(V1,V2,col=factor(Class))) +

geom_point(alpha=0.2)

# imbalance is an issue.

creditcard %>%

group_by(Class) %>%

count() %>%

ungroup() %>%

mutate(n = n/sum(n))

#> # A tibble: 2 x 2

#> Class n

#> <int> <dbl>

#> 1 0 0.998

#> 2 1 0.00186

Use ovun.sample from ROSE package to do over/under - sampling or

combination of the two.

Oversampling

# We hope minority in the new sample is 40%.

# We know majority size is

sum(creditcard$Class == 0)

#> [1] 28428

# sum(creditcard$Class == 0)/(1-0.4) is the desired sample size.

library(ROSE)

oversampling_result <-

ovun.sample(

Class ~ .

,data = creditcard

,method = "over"

,N = sum(creditcard$Class == 0)/(1-0.4)

,seed = 2018)

# N - the sampling size you want.

oversampled_credit <- oversampling_result$data

table(oversampled_credit$Class)

#>

#> 0 1

#> 28428 18952

table(creditcard$Class)

#>

#> 0 1

#> 28428 53

prop.table(table(oversampled_credit$Class))

#>

#> 0 1

#> 0.6 0.4

prop.table(table(creditcard$Class))

#>

#> 0 1

#> 0.99813911 0.00186089

完成sampling的工作。

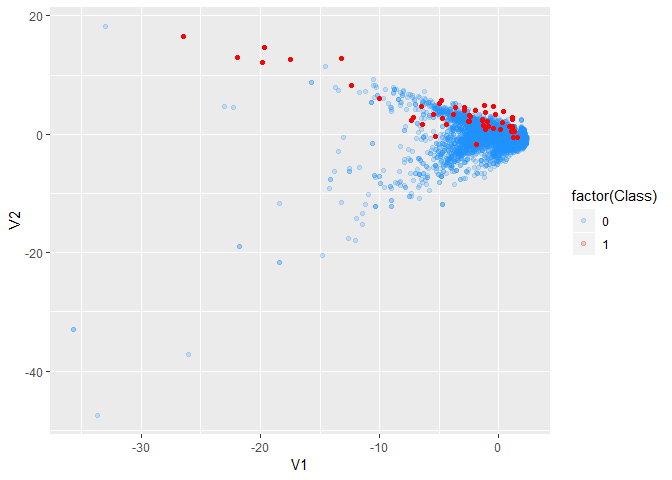

oversampled_credit %>%

ggplot(aes(V1,V2,col=factor(Class))) +

scale_color_manual(values = c('dodgerblue', 'red')) +

# customize the color for the points.

geom_point(alpha=0.2)

# imbalance is solved.

Undersampling

# We hope minority in the new sample is 40%.

# We know minority size is

sum(creditcard$Class == 1)

#> [1] 53

# sum(creditcard$Class == 1)/0.4 is the desired sample size.

undersampling_result <-

ovun.sample(

Class ~ .

,data = creditcard

,method = "under"

,N = sum(creditcard$Class == 1)/0.4

,seed = 2018)

# N - the sampling size you want.

undersampled_credit <- undersampling_result$data

table(undersampled_credit$Class)

#>

#> 0 1

#> 79 53

prop.table(table(undersampled_credit$Class))

#>

#> 0 1

#> 0.5984848 0.4015152

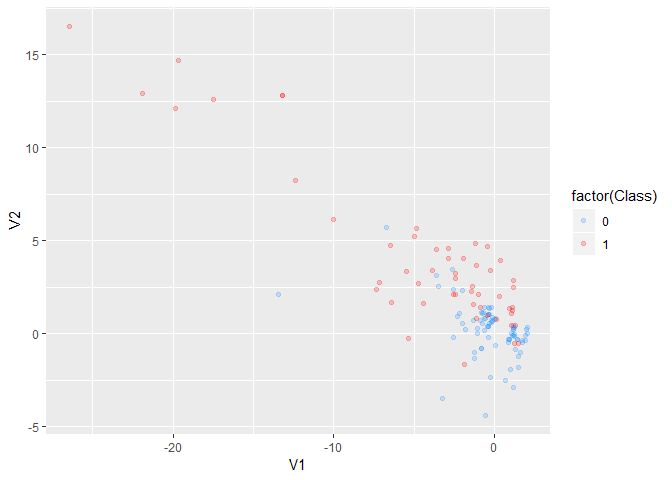

undersampled_credit %>%

ggplot(aes(V1,V2,col=factor(Class))) +

scale_color_manual(values = c('dodgerblue', 'red')) +

geom_point(alpha=0.2)

# imbalance is solved.

Over and Undersampling

bothsampling_result <-

ovun.sample(

Class ~ .

,data = creditcard

,method = "both"

,N = nrow(creditcard)

,p = 0.5

,seed = 2018)

# N - the sampling size you want.

bothsampled_credit <- bothsampling_result$data

table(bothsampled_credit$Class)

#>

#> 0 1

#> 14365 14116

prop.table(table(bothsampled_credit$Class))

#>

#> 0 1

#> 0.5043713 0.4956287

table(creditcard$Class)

#>

#> 0 1

#> 28428 53

# both actions are done.

# oversampling the majority

# undersampling the minority.

bothsampled_credit %>%

ggplot(aes(V1,V2,col=factor(Class))) +

scale_color_manual(values = c('dodgerblue', 'red')) +

geom_point(alpha=0.2)

# imbalance is solved.

SMOTE

Chawla et al. (2002) 提出SMOTE方法,用于解决不平衡样本的问题。

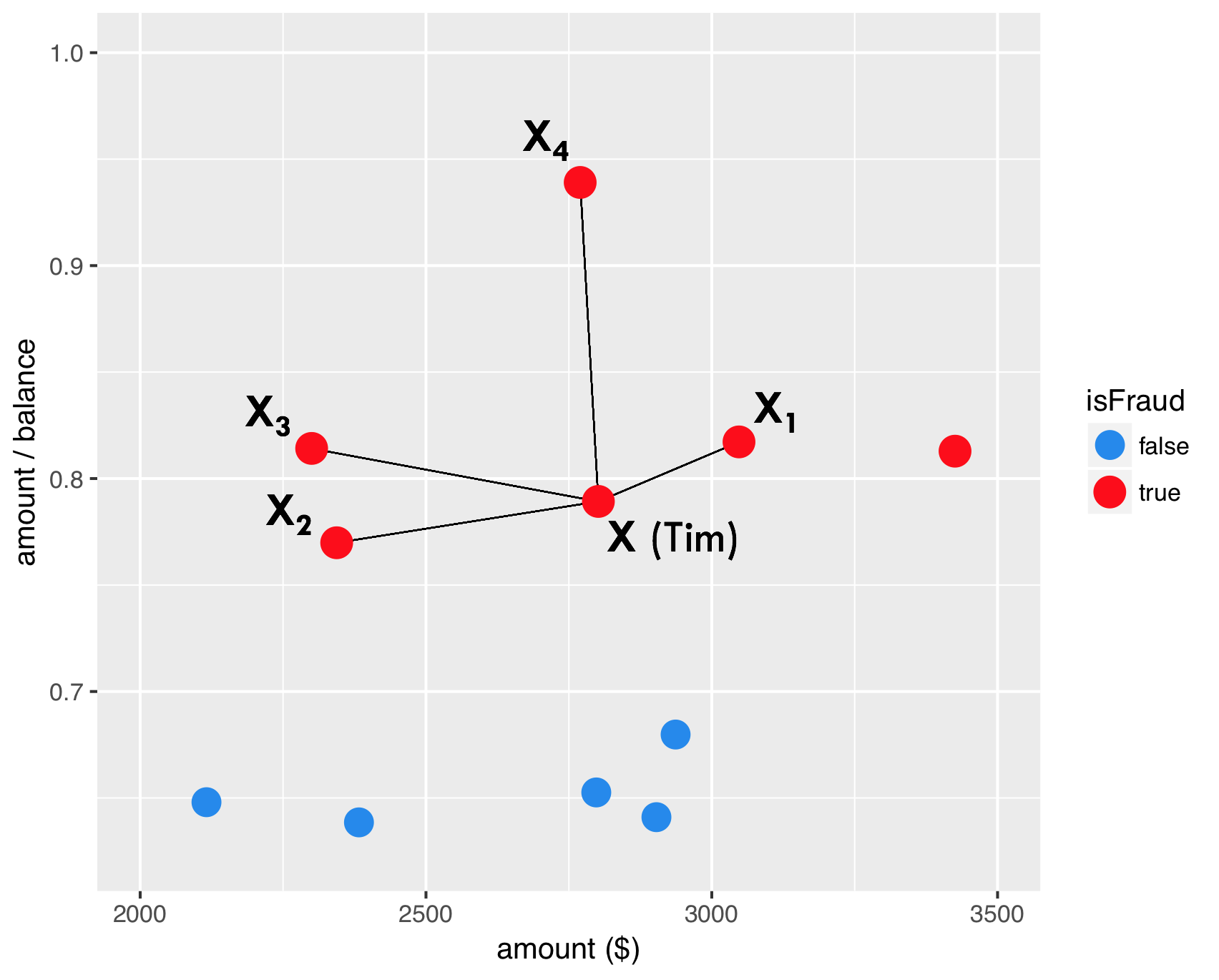

intro

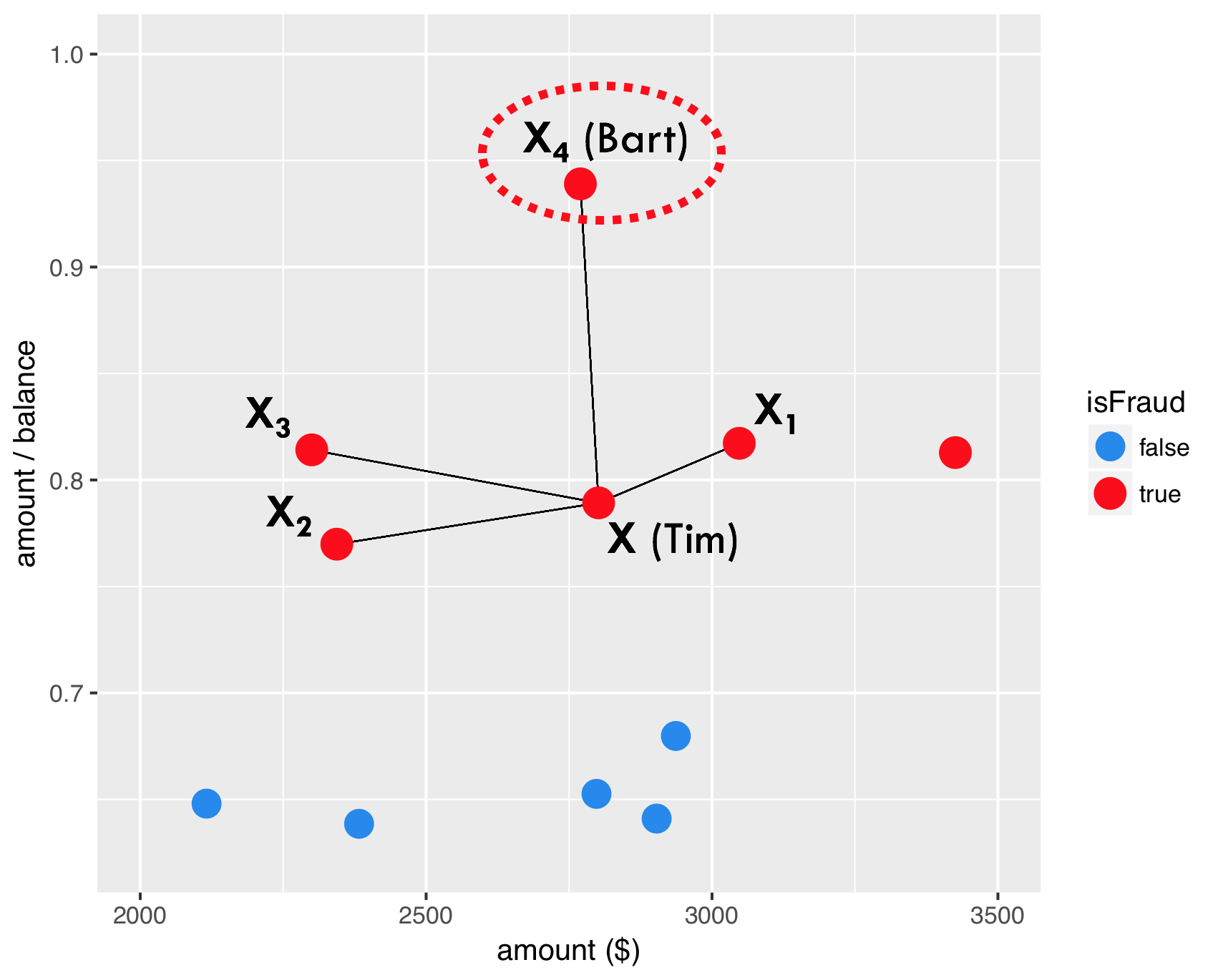

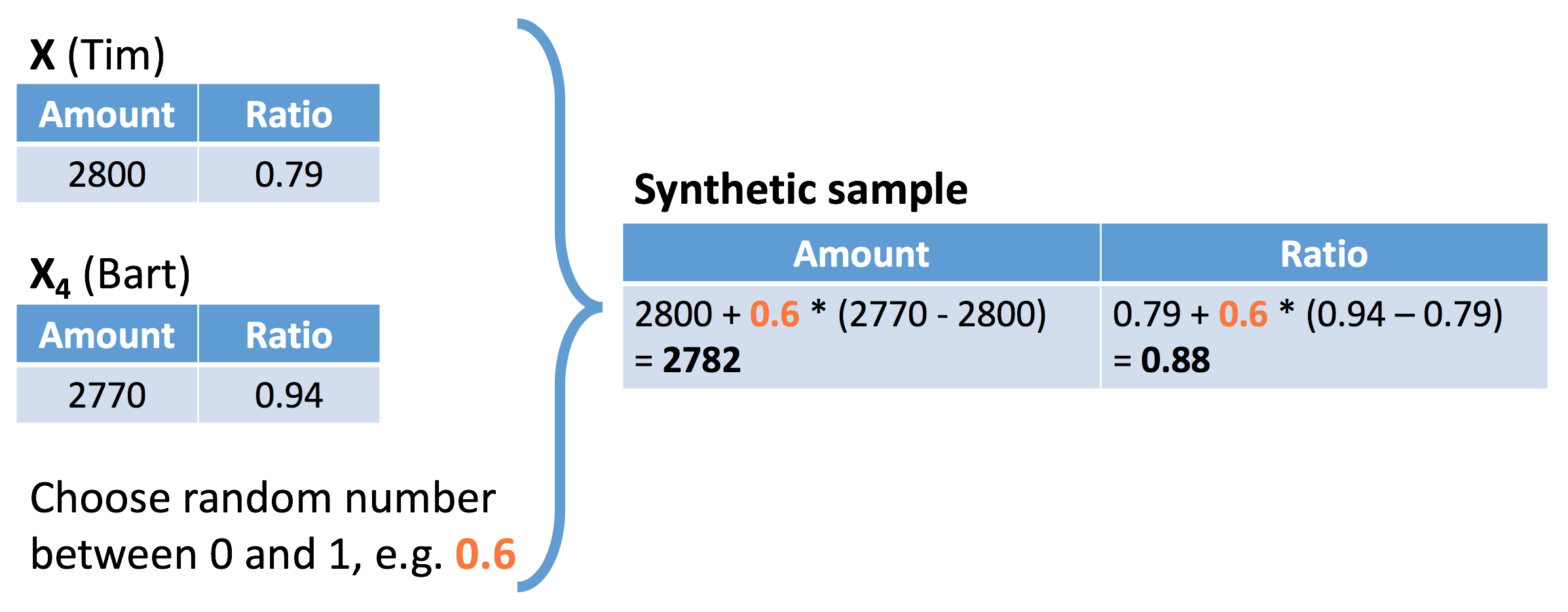

如图,红色点表示欺诈用户在两变量上的表现,分别连线。

任意选择一点。

选择任意比例,构建两点间的一个样本。

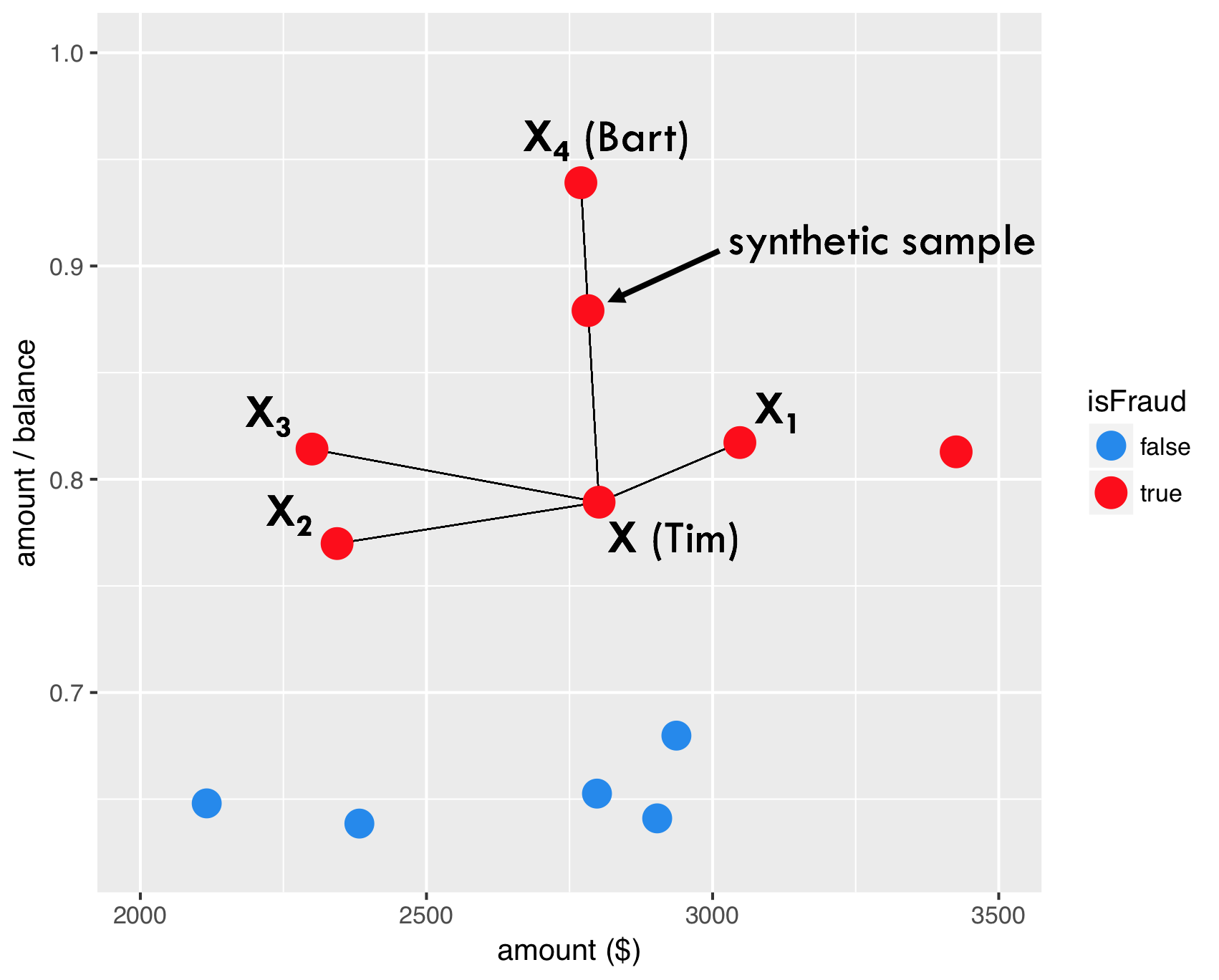

因此,SMOTE产生的新样本出现了。

dup_sizeparameter answers the question how many times SMOTE should loop through the existing, real fraud cases.

同时参数dup_size给定SMOTE算法需要给每个y=1产生多少个新的样本。

modeling

library(smotefamily)

SMOTE can only be applied based on numeric variables since it uses the euclidean distance to determine nearest neighbors.

# Set the number of fraud and legitimate cases, and the desired percentage of legitimate cases

n1 <- sum(creditcard$Class==1)

n0 <- sum(creditcard$Class==0)

r0 <- 0.6

# r0: the desired percentage

# Calculate the value for the dup_size parameter of SMOTE

ntimes <- ((1 - r0) / r0) * (n0 / n1) - 1

# Create synthetic fraud cases with SMOTE

library(data.table)

smote_output <- SMOTE(X = creditcard %>% select(-Time,Class), target = creditcard$Class, K = 5, dup_size = ntimes)

# remove non-numeric vars

# Make a scatter plot of the original and over-sampled dataset

credit_smote <- smote_output$data

colnames(credit_smote)[30] <- "Class"

prop.table(table(credit_smote$Class))

#>

#> 0 1

#> 0.6003928 0.3996072

ggplot(creditcard, aes(x = V1, y = V2, color = factor(Class))) +

geom_point() +

scale_color_manual(values = c('dodgerblue2', 'red'))

ggplot(credit_smote, aes(x = V1, y = V2, color = factor(Class))) +

geom_point() +

scale_color_manual(values = c('dodgerblue2', 'red'))

- 你会发现,通过SMOTE算法,以后很多点连成了直线,具体见 @ref(smoteintro)

报错`Errorin knearest(P_set, P_set, K) : 找不到对象'knD'`

1. 函数为`smotefamily::SMOTE` 1 [CSDN博客](https://blog.csdn.net/scc_hy/article/details/84190080)介绍其他的R中SMOTE的包 2. 解决办法是`install.packages("FNN")` 参考 [Stack Overflow](https://stackoverflow.com/questions/40206172/error-in-knearestdarr-p-set-k-object-knd-not-found?answertab=oldest)- `ntimes <- ((1

- r0) / r0) * (n0 / n1) - 1`理解公式

split train and test

这里用于验证SMOTE方法是否有提高模型效果。

dim(creditcard)

#> [1] 28481 31

set.seed(123)

creditcard <- creditcard %>% mutate(Class = as.factor(Class))

train_index <- sample(nrow(creditcard),round(0.5*nrow(creditcard)))

train <- creditcard[train_index,]

test <- creditcard[-train_index,]

library(rpart)

model01 <- rpart(factor(Class) ~ ., data = train)

library(caret)

scores01 <- predict(model01,newdata=test,type = "prob")[,2]

predicted_class01 <- ifelse(scores01>0.5,1,0) %>% factor()

confusionMatrix(

data = predicted_class01

,reference = test$Class

)

#> Confusion Matrix and Statistics

#>

#> Reference

#> Prediction 0 1

#> 0 14216 7

#> 1 7 11

#>

#> Accuracy : 0.999

#> 95% CI : (0.9984, 0.9995)

#> No Information Rate : 0.9987

#> P-Value [Acc > NIR] : 0.2079

#>

#> Kappa : 0.6106

#> Mcnemar's Test P-Value : 1.0000

#>

#> Sensitivity : 0.9995

#> Specificity : 0.6111

#> Pos Pred Value : 0.9995

#> Neg Pred Value : 0.6111

#> Prevalence : 0.9987

#> Detection Rate : 0.9982

#> Detection Prevalence : 0.9987

#> Balanced Accuracy : 0.8053

#>

#> 'Positive' Class : 0

#>

library(pROC)

auc(roc(response = test$Class, predictor = scores01))

#> Area under the curve: 0.8054

library(smotefamily)

set.seed(123)

smote_result <- SMOTE(X = train %>% select(-Class),target = train$Class,K = 10, dup_size = 50)

train_oversampled <-

smote_result$data %>%

mutate(Class = class)

prop.table(table(train$Class))

#>

#> 0 1

#> 0.997542135 0.002457865

prop.table(table(train_oversampled$Class))

#>

#> 0 1

#> 0.8883677 0.1116323

library(rpart)

model02<- rpart(Class ~ ., data = train_oversampled)

library(rpart)

model02 <- rpart(factor(Class) ~ ., data = train)

library(caret)

scores02 <- predict(model02,newdata=test,type = "prob")[,2]

predicted_class02 <- ifelse(scores02>0.5,1,0) %>% factor()

confusionMatrix(

data = predicted_class02

,reference = test$Class

)

#> Confusion Matrix and Statistics

#>

#> Reference

#> Prediction 0 1

#> 0 14216 7

#> 1 7 11

#>

#> Accuracy : 0.999

#> 95% CI : (0.9984, 0.9995)

#> No Information Rate : 0.9987

#> P-Value [Acc > NIR] : 0.2079

#>

#> Kappa : 0.6106

#> Mcnemar's Test P-Value : 1.0000

#>

#> Sensitivity : 0.9995

#> Specificity : 0.6111

#> Pos Pred Value : 0.9995

#> Neg Pred Value : 0.6111

#> Prevalence : 0.9987

#> Detection Rate : 0.9982

#> Detection Prevalence : 0.9987

#> Balanced Accuracy : 0.8053

#>

#> 'Positive' Class : 0

#>

library(pROC)

auc(roc(response = test$Class, predictor = scores02))

#> Area under the curve: 0.8054

SMOTE 并不是每次都有效果,因此要通过这种方法进行验证。

cost model

在不平衡样本中,ACC是有误导的,因此引入成本矩阵。

here::here('pic','cost_matrix.png') %>%

knitr::include_graphics()

SMOTE : Synthetic Minority Oversampling TEchnique (Chawla et al., 2002)

- 你会发现,通过SMOTE算法,以后很多点连成了直线,具体见 @ref(smoteintro)

报错`Errorin knearest(P_set, P_set, K) : 找不到对象'knD'`

1. 函数为`smotefamily::SMOTE` 1 [CSDN博客](https://blog.csdn.net/scc_hy/article/details/84190080)介绍其他的R中SMOTE的包 2. 解决办法是`install.packages("FNN")` 参考 [Stack Overflow](https://stackoverflow.com/questions/40206172/error-in-knearestdarr-p-set-k-object-knd-not-found?answertab=oldest)- `ntimes <- ((1

- r0) / r0) * (n0 / n1) - 1`理解公式

split train and test

这里用于验证SMOTE方法是否有提高模型效果。

dim(creditcard)

#> [1] 28481 31

set.seed(123)

creditcard <- creditcard %>% mutate(Class = as.factor(Class))

train_index <- sample(nrow(creditcard),round(0.5*nrow(creditcard)))

train <- creditcard[train_index,]

test <- creditcard[-train_index,]

library(rpart)

model01 <- rpart(factor(Class) ~ ., data = train)

library(caret)

scores01 <- predict(model01,newdata=test,type = "prob")[,2]

predicted_class01 <- ifelse(scores01>0.5,1,0) %>% factor()

confusionMatrix(

data = predicted_class01

,reference = test$Class

)

#> Confusion Matrix and Statistics

#>

#> Reference

#> Prediction 0 1

#> 0 14216 7

#> 1 7 11

#>

#> Accuracy : 0.999

#> 95% CI : (0.9984, 0.9995)

#> No Information Rate : 0.9987

#> P-Value [Acc > NIR] : 0.2079

#>

#> Kappa : 0.6106

#> Mcnemar's Test P-Value : 1.0000

#>

#> Sensitivity : 0.9995

#> Specificity : 0.6111

#> Pos Pred Value : 0.9995

#> Neg Pred Value : 0.6111

#> Prevalence : 0.9987

#> Detection Rate : 0.9982

#> Detection Prevalence : 0.9987

#> Balanced Accuracy : 0.8053

#>

#> 'Positive' Class : 0

#>

library(pROC)

auc(roc(response = test$Class, predictor = scores01))

#> Area under the curve: 0.8054

library(smotefamily)

set.seed(123)

smote_result <- SMOTE(X = train %>% select(-Class),target = train$Class,K = 10, dup_size = 50)

train_oversampled <-

smote_result$data %>%

mutate(Class = class)

prop.table(table(train$Class))

#>

#> 0 1

#> 0.997542135 0.002457865

prop.table(table(train_oversampled$Class))

#>

#> 0 1

#> 0.8883677 0.1116323

library(rpart)

model02<- rpart(Class ~ ., data = train_oversampled)

library(rpart)

model02 <- rpart(factor(Class) ~ ., data = train)

library(caret)

scores02 <- predict(model02,newdata=test,type = "prob")[,2]

predicted_class02 <- ifelse(scores02>0.5,1,0) %>% factor()

confusionMatrix(

data = predicted_class02

,reference = test$Class

)

#> Confusion Matrix and Statistics

#>

#> Reference

#> Prediction 0 1

#> 0 14216 7

#> 1 7 11

#>

#> Accuracy : 0.999

#> 95% CI : (0.9984, 0.9995)

#> No Information Rate : 0.9987

#> P-Value [Acc > NIR] : 0.2079

#>

#> Kappa : 0.6106

#> Mcnemar's Test P-Value : 1.0000

#>

#> Sensitivity : 0.9995

#> Specificity : 0.6111

#> Pos Pred Value : 0.9995

#> Neg Pred Value : 0.6111

#> Prevalence : 0.9987

#> Detection Rate : 0.9982

#> Detection Prevalence : 0.9987

#> Balanced Accuracy : 0.8053

#>

#> 'Positive' Class : 0

#>

library(pROC)

auc(roc(response = test$Class, predictor = scores02))

#> Area under the curve: 0.8054

SMOTE 并不是每次都有效果,因此要通过这种方法进行验证。

cost model

在不平衡样本中,ACC是有误导的,因此引入成本矩阵。

here::here('pic','cost_matrix.png') %>%

knitr::include_graphics()

如图,一共有两种成本

仿照PPT出题

- Cost of analyzing the case

- 被欺诈损失的本金

加入SMOTE 的结构后,模型变得更加复杂了,更好了。

因此成本函数可以定义为

cost_model

定义。

[Cost(\text{model})=\sum_{i=1}^{N}y_i(1-\hat y_i)\text{Amount}_i + \hat y_i C_a]

- (y_i)为真实值

- (\hat y_i)为预测值

ACC 是有误导的。

cost_model <- function(predicted.classes, true.classes, amounts, fixedcost) {

library(hmeasure)

predicted.classes <- relabel(predicted.classes)

true.classes <- relabel(true.classes)

cost <- sum(true.classes * (1 - predicted.classes) * amounts + predicted.classes * fixedcost)

return(cost)

}

cost_model(

predicted.classes = predicted_class01

,true.classes = test$Class

,amounts = test$Amount

,fixedcost = 10

)

#> [1] 1140.63

cost_model(

predicted.classes = predicted_class02

,true.classes = test$Class

,amounts = test$Amount

,fixedcost = 10

)

#> [1] 1140.63

- 说明SMOTE 算法无效。

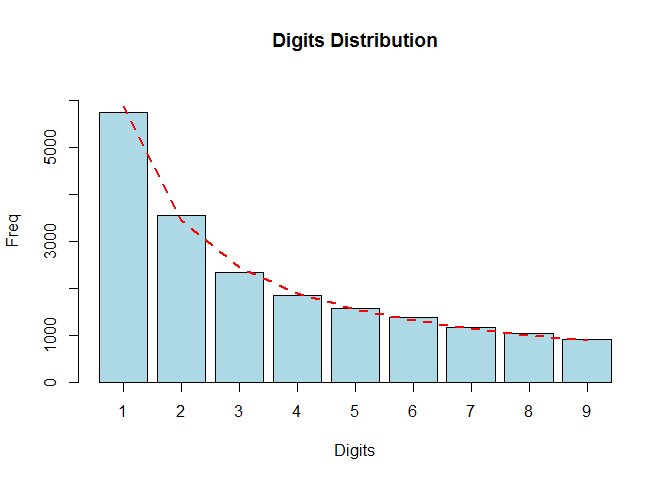

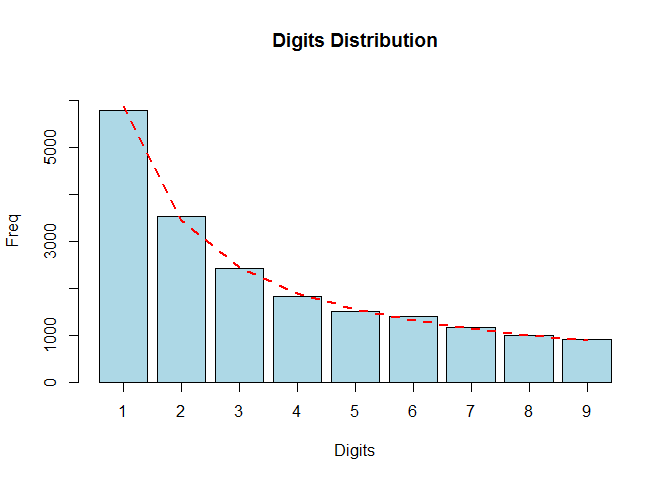

Benford’s law for digits

Benford’s law for the first digit

[P(D_1 = d_1) = \log(d_1+1) - \log(d_1) = \log(1 + \frac{1}{d_1});d_1 = 1,\dots,9]

benford_data <-

tibble(

d_1 = 1:9

,P = log10(d_1+1) - log10(d_1)

)

benford_data

#> # A tibble: 9 x 2

#> d_1 P

#> <int> <dbl>

#> 1 1 0.301

#> 2 2 0.176

#> 3 3 0.125

#> 4 4 0.0969

#> 5 5 0.0792

#> 6 6 0.0669

#> 7 7 0.0580

#> 8 8 0.0512

#> 9 9 0.0458

benford_data %>%

summarise(sum(P))

#> # A tibble: 1 x 1

#> `sum(P)`

#> <dbl>

#> 1 1

- 也可以检验概率和为1

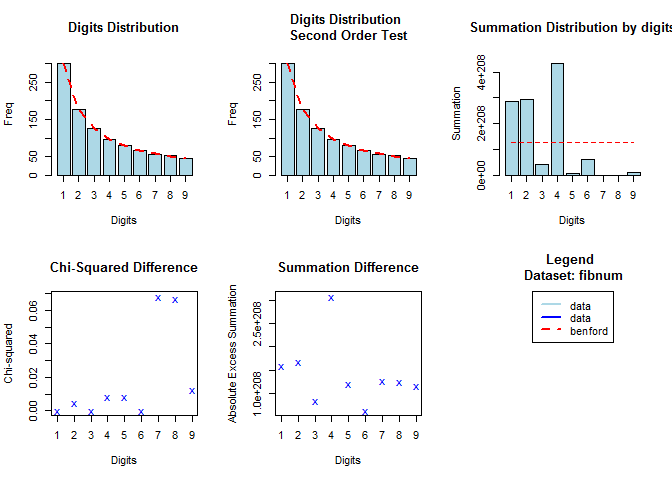

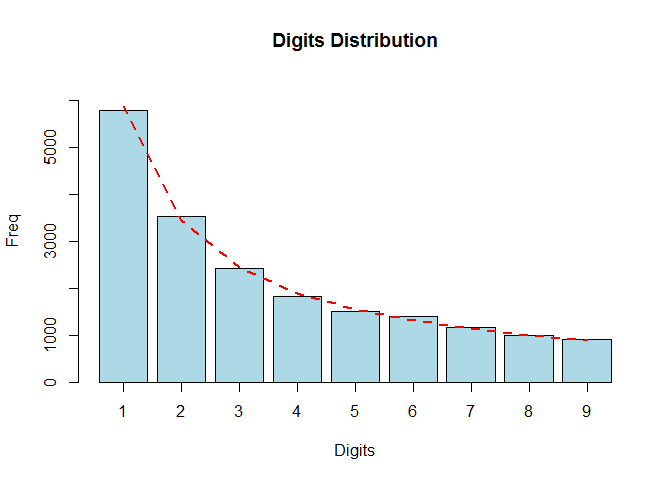

Test on the Fibonacci sequence

The Fibonacci sequence is characterized by the fact that every number after the first two is the sum of the two preceding ones. (Baesens, Höppner, and Verdonck 2018)

n <- 1000

fibnum <- numeric(n)

fibnum[1] <- 1

fibnum[2] <- 1

for (i in 3:n) {

fibnum[i] <- fibnum[i-1]+fibnum[i-2]

}

head(fibnum)

#> [1] 1 1 2 3 5 8

library(benford.analysis)

bfd.fib <- benford(fibnum,

number.of.digits = 1)

plot(bfd.fib)

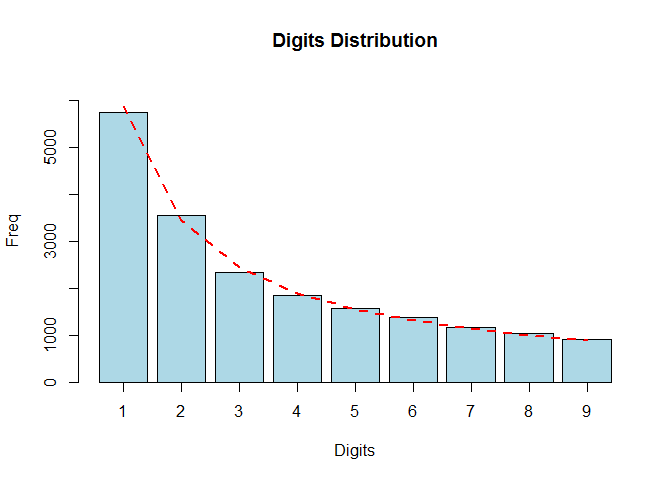

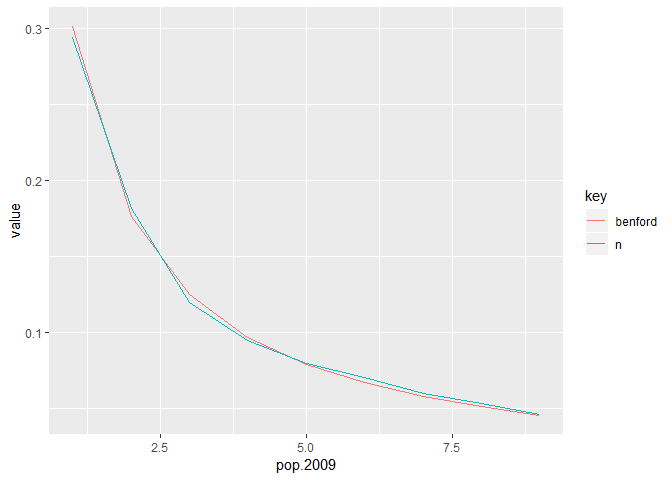

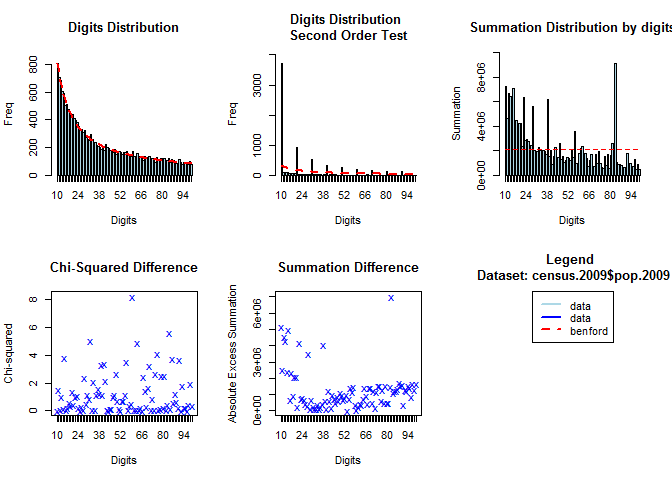

Test on census.2009

census.2009

contains the populations of 19509 towns and cities of the United States (July 2009) and was used in Nigrini and Wells (2012).

# Load package benford.analysis

library(benford.analysis)

data(census.2009)

# Check conformity

bfd.cen <- benford(census.2009$pop.2009, number.of.digits = 1)

plot(bfd.cen, except = c("second order", "summation", "mantissa", "chi squared","abs diff", "ex summation", "Legend"), multiple = F)

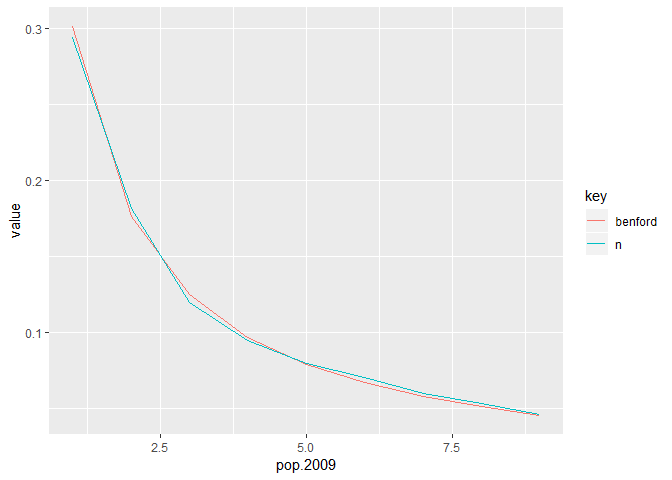

census.2009 %>%

transmute(pop.2009 = pop.2009 %>%

as.character %>%

str_sub(1,1) %>%

as.integer

) %>%

group_by(pop.2009) %>%

count() %>%

ungroup() %>%

mutate(n = n/sum(n)) %>%

mutate(benford = log10(1+1/pop.2009)) %>%

gather(key,value,n:benford) %>%

ggplot(aes(x=pop.2009,y=value,col=key)) +

geom_line()

# Multiply the data by 3 and check conformity again

data <- census.2009$pop.2009 * 3

bfd.cen3 <- benford(data, number.of.digits=1)

plot(bfd.cen3, except = c("second order", "summation", "mantissa", "chi squared","abs diff", "ex summation", "Legend"), multiple = F)

- 因此满足 benford 定律。

plot.Benford存在bug。

Satisfication

Many datasets satisfy Benford’s Law

- data where numbers represent sizes of facts or events

- data in which numbers have no relationship to each other

- data sets that grow exponentially or arise from multiplicative fluctuations

- mixtures of different data sets

- Some well-known infinite integer sequences

- Fibonacci sequence

- Preferably, more than 1000 numbers that go across multiple orders.

Such as

- accounting transactions

- credit card transactions

- customer balances

- death rates

- diameter of planets

- electricity and telephone bills

- Fibonacci numbers

- incomes

- insurance claims

- lengths and flow rates of rivers

- loan data

- numbers of newspaper articles

- physical and mathematical constants

- populations of cities

- powers of 2

- purchase orders

- stock and house prices

- 可以做特征工程

| 这些可以不用记忆,等之后使用了再融会贯通。 | merged common ancestors ======= |

cost_model(

predicted.classes = predicted_class01

,true.classes = test$Class

,amounts = test$Amount

,fixedcost = 10

)

#> [1] 1140.63

cost_model(

predicted.classes = predicted_class02

,true.classes = test$Class

,amounts = test$Amount

,fixedcost = 10

)

#> [1] 1140.63

- 说明SMOTE 算法无效。

Benford’s law for digits

Benford’s law for the first digit

[P(D_1 = d_1) = \log(d_1+1) - \log(d_1) = \log(1 + \frac{1}{d_1});d_1 = 1,\dots,9]

benford_data <-

tibble(

d_1 = 1:9

,P = log10(d_1+1) - log10(d_1)

)

benford_data

#> # A tibble: 9 x 2

#> d_1 P

#> <int> <dbl>

#> 1 1 0.301

#> 2 2 0.176

#> 3 3 0.125

#> 4 4 0.0969

#> 5 5 0.0792

#> 6 6 0.0669

#> 7 7 0.0580

#> 8 8 0.0512

#> 9 9 0.0458

benford_data %>%

summarise(sum(P))

#> # A tibble: 1 x 1

#> `sum(P)`

#> <dbl>

#> 1 1

- 也可以检验概率和为1

Test on the Fibonacci sequence

The Fibonacci sequence is characterized by the fact that every number after the first two is the sum of the two preceding ones. (Baesens, Höppner, and Verdonck 2018)

n <- 1000

fibnum <- numeric(n)

fibnum[1] <- 1

fibnum[2] <- 1

for (i in 3:n) {

fibnum[i] <- fibnum[i-1]+fibnum[i-2]

}

head(fibnum)

#> [1] 1 1 2 3 5 8

library(benford.analysis)

bfd.fib <- benford(fibnum,

number.of.digits = 1)

plot(bfd.fib)

Test on census.2009

census.2009

contains the populations of 19509 towns and cities of the United States (July 2009) and was used in Nigrini and Wells (2012).

# Load package benford.analysis

library(benford.analysis)

data(census.2009)

# Check conformity

bfd.cen <- benford(census.2009$pop.2009, number.of.digits = 1)

plot(bfd.cen, except = c("second order", "summation", "mantissa", "chi squared","abs diff", "ex summation", "Legend"), multiple = F)

census.2009 %>%

transmute(pop.2009 = pop.2009 %>%

as.character %>%

str_sub(1,1) %>%

as.integer

) %>%

group_by(pop.2009) %>%

count() %>%

ungroup() %>%

mutate(n = n/sum(n)) %>%

mutate(benford = log10(1+1/pop.2009)) %>%

gather(key,value,n:benford) %>%

ggplot(aes(x=pop.2009,y=value,col=key)) +

geom_line()

# Multiply the data by 3 and check conformity again

data <- census.2009$pop.2009 * 3

bfd.cen3 <- benford(data, number.of.digits=1)

plot(bfd.cen3, except = c("second order", "summation", "mantissa", "chi squared","abs diff", "ex summation", "Legend"), multiple = F)

>>>>>>> fa6684efee460f284f61fd9d1fd6f08b62855b82

>>>>>>> fa6684efee460f284f61fd9d1fd6f08b62855b82

<<<<<<< HEAD 某些数据是不满足 Benfold 规则的, ||||||| merged common

ancestors # Digit analysis ======= 1. 因此满足 benford 定律。 1.

plot.Benford存在bug。

Satisfication

Many datasets satisfy Benford’s Law

- data where numbers represent sizes of facts or events

- data in which numbers have no relationship to each other

- data sets that grow exponentially or arise from multiplicative fluctuations

- mixtures of different data sets

- Some well-known infinite integer sequences

- Fibonacci sequence

- Preferably, more than 1000 numbers that go across multiple orders.

Such as

- accounting transactions

- credit card transactions

- customer balances

- death rates

- diameter of planets

- electricity and telephone bills

- Fibonacci numbers

- incomes

- insurance claims

- lengths and flow rates of rivers

- loan data

- numbers of newspaper articles

- physical and mathematical constants

- populations of cities

- powers of 2

- purchase orders

- stock and house prices

- 可以做特征工程

这些可以不用记忆,等之后使用了再融会贯通。

某些数据是不满足 Benfold 规则的, >>>>>>> fa6684efee460f284f61fd9d1fd6f08b62855b82

- If there is lower and/or upper bound or data is concentrated in narrow interval, e.g. hourly wage rate, height of people.

- If numbers are used as identification numbers or labels, e.g. social security number, flight numbers, car license plate numbers, phone numbers.

- Additive fluctuations instead of multiplicative fluctuations, e.g. heartbeats on a given day

Benford’s Law for the first-two digits

[P(D_1D_2 = d_1d_2) = \log(d_1d_2+1) - \log(d_1d_2) = \log(1 + \frac{1}{d_1d_2});d_1d_2 = 10,\dots,99]

benford_data <-

tibble(

d_1d_2 = 10:99

,P = log10(d_1d_2+1) - log10(d_1d_2)

)

benford_data

#> # A tibble: 90 x 2

#> d_1d_2 P

#> <int> <dbl>

#> 1 10 0.0414

#> 2 11 0.0378

#> 3 12 0.0348

#> 4 13 0.0322

#> 5 14 0.0300

#> 6 15 0.0280

#> 7 16 0.0263

#> 8 17 0.0248

#> 9 18 0.0235

#> 10 19 0.0223

#> # ... with 80 more rows

benford_data %>%

summarise(sum(P))

#> # A tibble: 1 x 1

#> `sum(P)`

#> <dbl>

#> 1 1

- 也可以检验概率和为1

This test is more reliable than the first digits test and is most frequently used in fraud detection. (Baesens, Höppner, and Verdonck 2018)

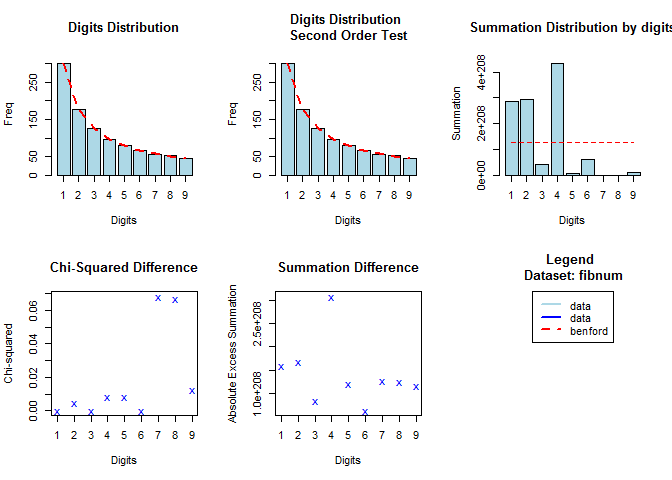

bfd.cen <- benford(census.2009$pop.2009,number.of.digits = 2)

plot(bfd.cen)

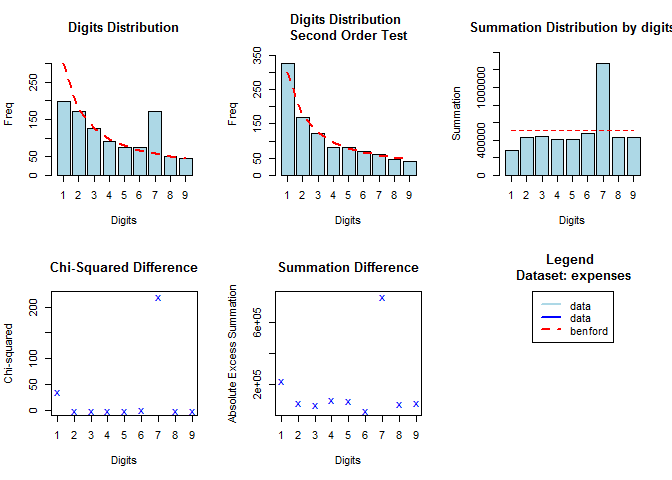

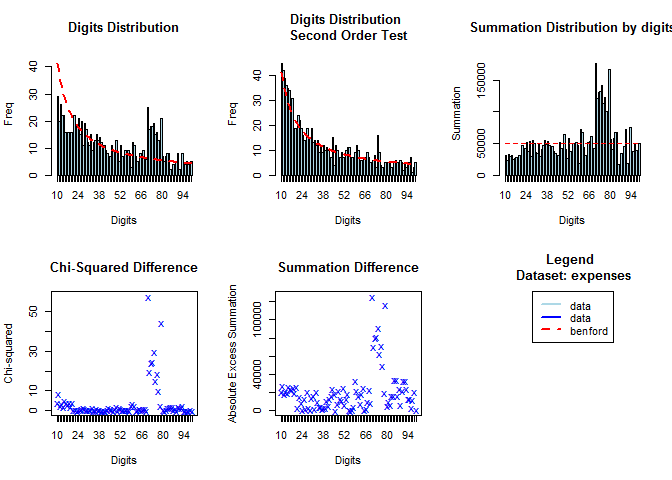

bfd1.exp <- benford(expenses, number.of.digits = 1)

plot(bfd1.exp)

bfd2.exp <- benford(expenses, number.of.digits = 2)

plot(bfd2.exp)

how to use

如上图一,字母在75左右时,数字没有符合 Benfold 规律,因此很有可能是人为因素,因此可以作为分类变量。

Robust statistics for Outliers

Robust z-scores

[z_i = \frac{x_i - \hat \mu}{\hat \sigma} = \frac{x_i - \text{Med}(X)}{\text{Mad}(X)}]

transfer <-

list.files('data',full.names = T) %>%

str_subset('transfer_chp4') %>%

map(~fread(.) %>% select(-id)) %>%

bind_cols()

# Get observations identified as fraud

which(transfers$fraud_flag == 1)

#> integer(0)

# Compute median and mean absolute deviation for `amount`

m <- median(transfers$amount)

s <- mad(transfers$amount)

# Compute robust z-score for each observation

robzscore <- abs((transfers$amount - m) / (s))

# Get observations with robust z-score higher than 3 in absolute value

which(abs(robzscore) > 3)

#> [1] 1 5 10 12 16 38 39 41 43 47 48 51 55

- 因此异常值的发现,相当于做一个分类变量。

- 这里

amount的异常值包含了四个欺诈用户的标签。 - 这里的z score 没有对

amount使用重复信息,它是根据amount的分布进行衍生的变量,算特征工程。

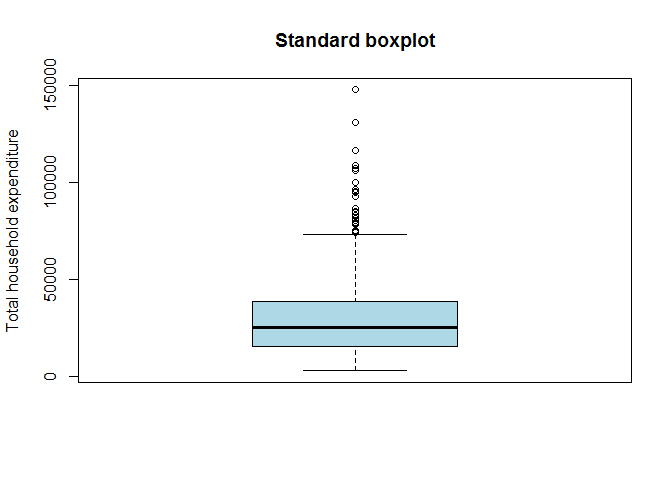

Boxplot

[[Q_1 - 1.5\text{IQR},Q_1 + 1.5\text{IQR}]]

thexp <- fread(here::here('data','thexp.csv'),drop='id')

thexp <- thexp$thexp

# Create boxplot

bp.thexp <- boxplot(thexp, col = "lightblue", main = "Standard boxplot", ylab = "Total household expenditure")

# Extract the outliers from the data

bp.thexp$out

#> [1] 96396 95389 84354 85065 86577 92957 106032 107065 74958 78286

#> [11] 108756 74111 78760 116262 74197 74993 99834 147498 81646 94587

#> [21] 74298 75043 83158 79147 108752 130773 80495

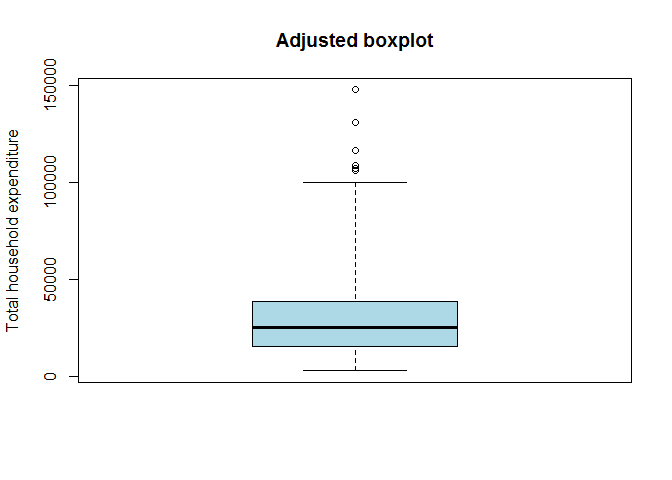

# Create adjusted boxplot

library(robustbase)

adj.thexp <- adjbox(thexp, col = "lightblue", main = "Adjusted boxplot", ylab = "Total household expenditure")

However, when the data are skewed, usually many points exceed the whiskers and are often erroneously declared as outliers. An adjustment of the boxplot is presented that includes a robust measure of skewness in the determination of the whiskers. (Hubert and Vandervieren 2004)

因此 Adjusted boxplot(Hubert and Vandervieren 2004) 主要是针对 Skewed 数据而错判异常值而提出的。

Skewed 数据而错判异常值而提出的,找资源,可以就看这个paper IQR怎么抉择

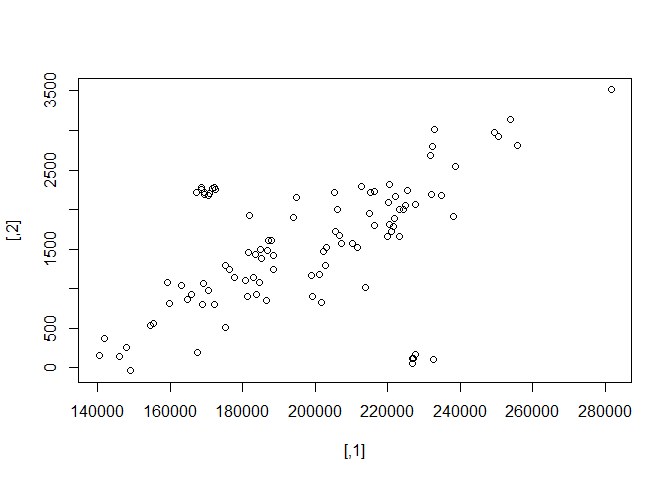

Use mahalanobis distance for multivariate outliers

在这种情况下,异常值可以是多维度确定。

knitr::include_graphics(here::here('pic','mahalanobiseuclidean_ggplot.png'))

Mahalanobis (or generalized) distance for observation is the distance from this observation to the center, taking into account the covariance matrix. (Baesens, Höppner, and Verdonck 2018)

Mhalanobis distance 因为考虑了协方差,因此比 Euclidean distance 更有合理的假设。

To detect multivariate outliers the mahalanobis distance is compared with a cut-off value, which is derived from the chisquare distribution. (Baesens, Höppner, and Verdonck 2018)

Mahalanobis 是如何从卡方从拿出来

根据tsi_real 和 p 可以剔除一些异常值

hailinsurance <-

fread(here::here('data','hailinsurance.csv'),sep=' ') %>%

dplyr::select(-V1) %>%

as.matrix()

plot(hailinsurance)

- 如图,可以发现有异常值。

# Compute the sample mean and sample covariance matrix

clcenter <- colMeans(hailinsurance)

clcov <- cov(hailinsurance)

clcenter

#> [,1] [,2]

#> 197898.973 1549.658

clcov

#> [,1] [,2]

#> [,1] 854093524 12530366.4

#> [,2] 12530366 622840.6

# Add 97.5% tolerance ellipsoid

rad <-

sqrt(qchisq(0.975, ncol(hailinsurance))) %>%

sqrt

library(car)

plot(hailinsurance)

# call plot before

ellipse(center = clcenter, shape = clcov, radius = rad, col = "blue", lty = 2)

为什么这里选择的是两列。

产生报错 Error in plot.xy(xy.coords(x, y), type = type, ...) : plot.new has

not been called yet 已经在

https://community.rstudio.com/t/error-in-plot-xy-xy-coords-x-y-type-type-plot-new-has-not-been-called-yet/18750?u=econkid

上提问了。 解决方式是之前要先call plot。

The function

qchisqcalculates a quantile from the chisquare distribution by giving as input parameters: 1) the probability (i.e. 97.5%) 2) the degrees of freedom.

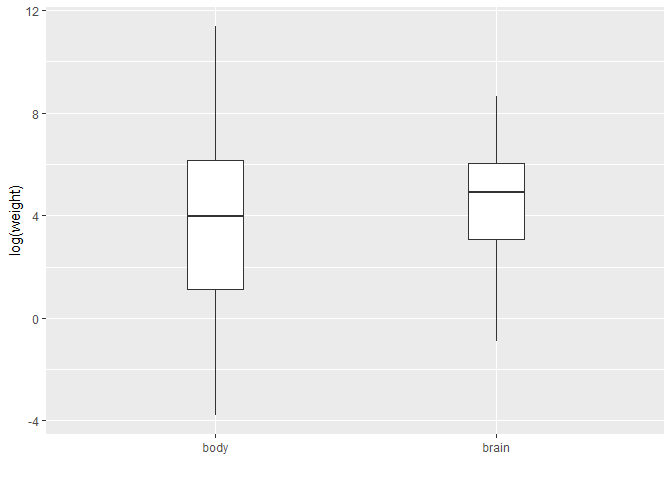

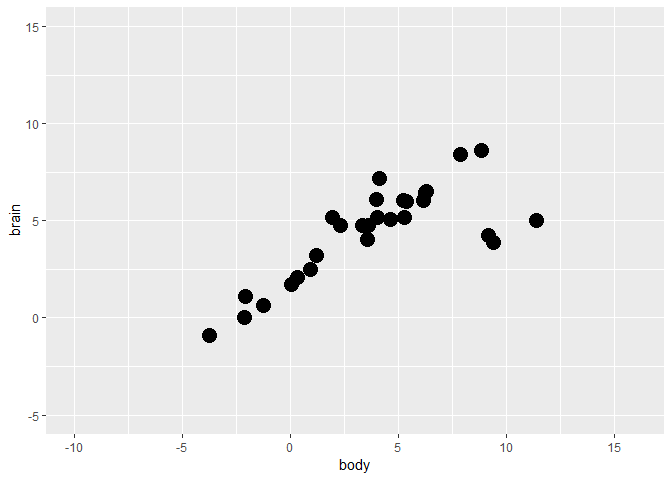

Animals data

Animals

containing the average brain and body weights for 28 species of land animals.

library(MASS)

data("Animals")

head(Animals)

#> # A tibble: 6 x 2

#> body brain

#> * <dbl> <dbl>

#> 1 1.35 8.1

#> 2 465 423

#> 3 36.3 120.

#> 4 27.7 115

#> 5 1.04 5.5

#> 6 11700 50

Animals <-

Animals %>%

mutate_all(log)

head(Animals)

#> # A tibble: 6 x 2

#> body brain

#> * <dbl> <dbl>

#> 1 0.300 2.09

#> 2 6.14 6.05

#> 3 3.59 4.78

#> 4 3.32 4.74

#> 5 0.0392 1.70

#> 6 9.37 3.91

Animals %>%

gather(key,value,body:brain) %>%

ggplot(aes(x = key, y = value)) +

stat_boxplot(width=0.2) +

ylab("log(weight)") +

xlab("")

fig <-

Animals %>%

ggplot(aes(x = body, y = brain)) +

geom_point(size = 5) +

ylim(-5, 15) +

scale_x_continuous(limits = c(-10, 16), breaks = seq(-15, 15, 5))

fig

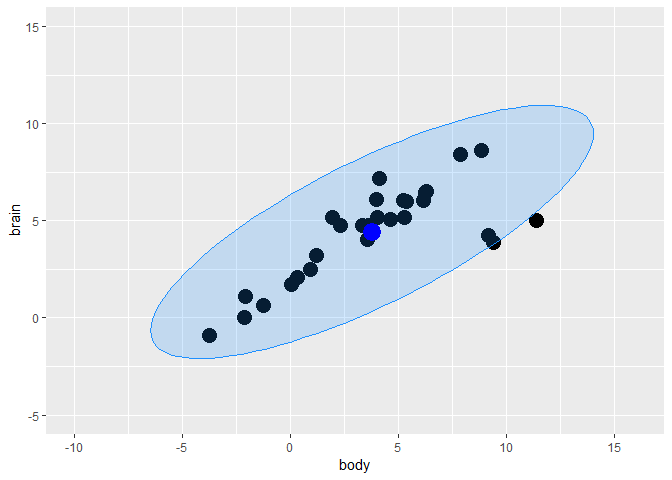

X <- Animals

animals.clcenter <- colMeans(X)

animals.clcov <- cov(X)

rad <- sqrt(qchisq(0.975, df = ncol(X)))

library(car)

ellipse.cl <-

data.frame(

ellipse(

center = animals.clcenter

,shape = animals.clcov

,radius = rad

,segments = 100

,draw = FALSE)

) %>%

`colnames<-`(colnames(X))

fig <-

fig +

geom_polygon(

data=ellipse.cl

,color = "dodgerblue"

,fill = "dodgerblue"

,alpha = 0.2) +

geom_point(aes(x = animals.clcenter[1]

,y = animals.clcenter[2])

,color = "blue"

,size = 6)

fig

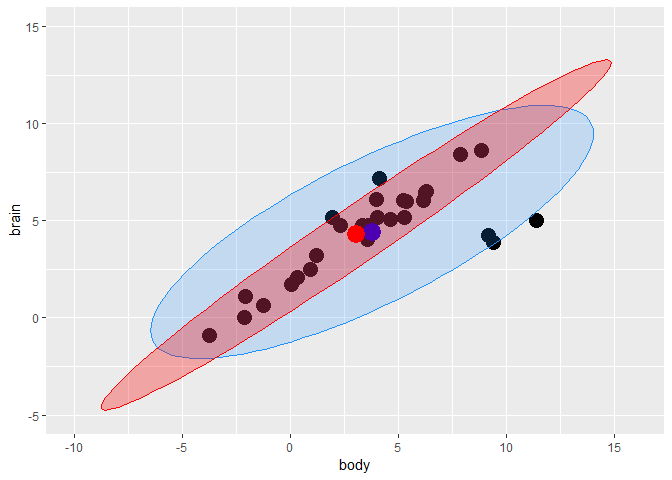

Minimum Covariance Determinant (MCD)

MCD looks for those h observations whose classical covariance matrix has the lowest possible determinant.

library(robustbase)

animals.mcd <- covMcd(X)

# Robust estimate of location

animals.mcd$center

#> body brain

#> 3.028827 4.275608

# Robust estimate of scatter

animals.mcd$cov

#> body brain

#> body 18.85849 14.16031

#> brain 14.16031 11.03351

library(robustbase)

animals.mcd <- covMcd(X)

ellipse.mcd <-

data.frame(

ellipse(

center = animals.mcd$center

,shape = animals.mcd$cov

,radius=rad

,segments=100

,draw=FALSE)

) %>%

`colnames<-`(colnames(X))

fig <-

fig +

geom_polygon(data=ellipse.mcd, color="red", fill="red", alpha=0.3) +

geom_point(aes(x = animals.mcd$center[1], y = animals.mcd$center[2]),color = "red", size = 6)

fig

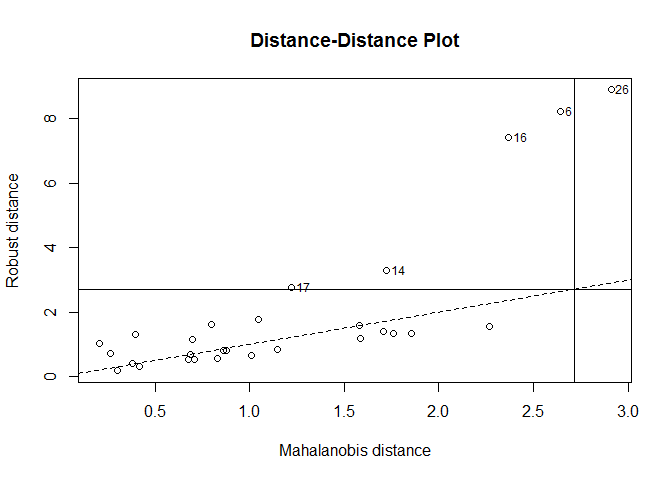

Distance-distance plot

当变量为三个时,可以用3D图进行可视化,但是 当变量超过3个以上,就无法可视化 tolerance ellipsoid 了。

The distance-distance plot shows the robust distance of each observation versus its classical Mahalanobis distance, obtained immediately from

MCDobject. (Baesens, Höppner, and Verdonck 2018)

distance-distance plot 没有理解 如何导出outlier呢?

plot(animals.mcd, which = "dd")

other

robust statistcis vs. classic statistics

受到更少的outlier影响

z-score 有robust boxplot 有箱型图

书签 https://campus.datacamp.com/courses/fraud-detection-in-r/digit-analysis-and-robust-statistics?ex=9